MARKET OVERVIEW

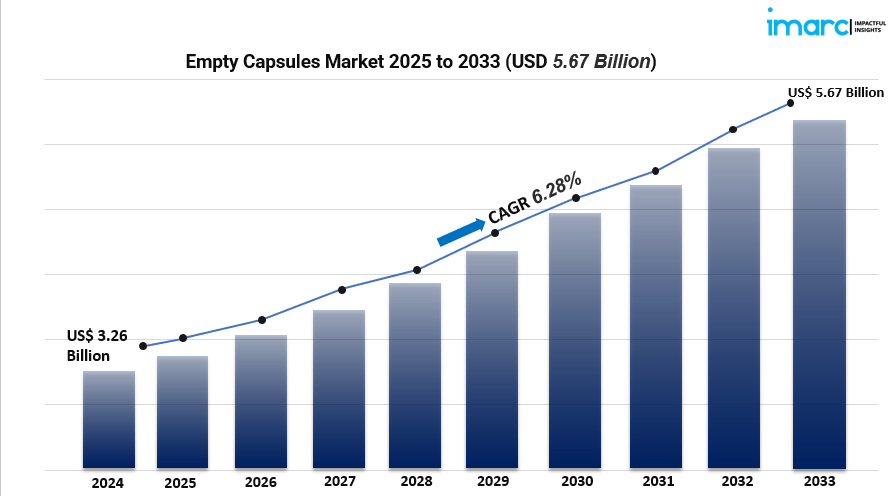

The global empty capsules market, valued at approximately USD 3.26 billion in 2024, is projected to reach USD 5.67 billion by 2033, growing at a CAGR of 6.28% from 2025 to 2033 . This growth is driven by rising health consciousness, increased use of nutraceuticals and pharmaceuticals, and the advent of plant-based and capsule-in-capsule technologies, offering enhanced safety and patient compliance in drug delivery.

STUDY ASSUMPTION YEARS

- BASE YEAR: 2024

- HISTORICAL YEAR: 2019–2024

- FORECAST YEAR: 2025–2033

EMPTY CAPSULES MARKET KEY TAKEAWAYS

- North America led the market in 2024 with over 34.5% share, propelled by capsule‑in‑capsule technology and robust pharmaceutical innovation .

- The market, at USD 3.26 billion in 2024, is forecast to reach USD 5.67 billion by 2033, growing at 6.28% CAGR .

- Gelatin remains the dominant type, especially porcine and bovine gelatin, due to ease of production and versatile use.

- Immediate-release capsules are the leading functionality, thanks to faster drug dissolution and enhanced bioavailability.

- Growing demand from pharmaceutical end-users is matched by rising nutraceutical uptake, with plant-based capsules gaining momentum.

- Technological advances such as vegetarian HPMC and capsule-in-capsule technology are reshaping production.

- Expansion in emerging regions and increasing self-medication trends support steady market expansion.

MARKET GROWTH FACTORS

- Technological Advancements in Capsule Materials

The market is really thriving thanks to some exciting innovations in capsule composition, especially with the emergence of non-gelatin alternatives like HPMC, pullulan, and starch-based shells. These vegetarian capsules are hitting the mark for consumers who are looking for natural, vegan-friendly options, and they fit perfectly with the clean-label trends we’re seeing in both nutraceuticals and pharmaceuticals. Plus, the popularity of capsule-in-capsule formats is on the rise, allowing for controlled release and better gastrointestinal safety—this is particularly crucial for high-potency or sensitive medications that cater to elderly patients or those with chronic conditions. Alongside ongoing research and development in excipients—like Roquette's LYCAGEL Flex pea starch premix—these innovations are boosting capsule functionality and sustainability, all while addressing the changing regulatory landscape and consumer preferences. - Regulatory and Industry Standards

Regulatory frameworks are playing a key role in this growth by promoting standardized capsule quality and providing affordable generic options. A great example is the introduction of generic doxycycline capsules in April 2024, which aims to enhance access and affordability in pharmaceutical care. Additionally, regulatory changes that favor plant-based ingredients are encouraging manufacturers like Lonza to ramp up production of vegetarian capsules, solidifying their dominance in the North American market. Manufacturers are also pouring resources into high-containment facilities and automation to meet strict regulatory standards and ensure consistent quality. These investments are not just about compliance; they also boost scalability and operational efficiency, allowing the market to quickly adapt to spikes in demand, like we saw during the COVID-19 pandemic. - Rising Market Demand and Demographics

The growing awareness around health and the trend of self-medication have significantly boosted the demand for empty capsules, especially for dietary supplements like vitamins and minerals. The nutraceutical market reached a whopping USD 468.5 billion in 2023 and is projected to soar to USD 856.3 billion by 2032, which is driving up the use of capsules. Moreover, with the global population aging—predictions suggest that the number of people over 80 will triple by 2050—there's an increasing need for chronic therapies, and capsules are often favored for their ease of swallowing and precise dosage. The pandemic also played a role in this shift, as it spurred a rise in demand for immune-health supplements. Emerging markets, particularly in Asia Pacific and Latin America, are showing a strong appetite for capsules, thanks to the growth of the pharmaceutical industry and a rise in consumer spending on self-care.

Request for a sample copy of this report: https://www.imarcgroup.com/empty-capsules-market/requestsample

MARKET SEGMENTATION

By Type

- Gelatin Capsule: Animal‑derived capsules widely used in pharmaceutical and nutraceutical applications.

- Non-gelatin Capsule: Vegetarian capsules made from materials like HPMC, pullulan, and starch.

By Raw Material

- Pig Meat: Porcine gelatin base for capsule shells.

- Bovine Meat: Capsules sourced from cattle-derived gelatin.

- Bone: Bone-meal derived gelatin for capsule production.

- Hydroxypropyl Methylcellulose (HPMC): Plant-based cellulose for vegetarian capsules.

- Others: Labels unspecified, including starch, pullulan, etc.

By Functionality

- Immediate-release Capsules: Dissolve quickly for rapid therapeutic effect.

- Sustained-release Capsules: Provide controlled drug release over time.

- Delayed-release Capsules: Designed to dissolve in specific parts of the GI tract.

By Therapeutic Application

- Antibiotic and Antibacterial Drugs

- Vitamins and Dietary Supplements

- Antacid and Antiflatulent Preparations

- Cardiovascular Therapy Drugs

- Others

By End User

- Pharmaceutical Industry

- Nutraceutical Industry

- Cosmetics Industry

- Others

Breakup by Region

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

REGIONAL INSIGHTS

North America leads the global empty capsules market, holding over 34.5% of the share in 2024. This dominance is supported by a robust pharmaceutical infrastructure, a quick adoption of vegetarian and capsule-in-capsule technologies, and high consumption of nutraceuticals. The United States alone makes up about 86% of North America’s market, driven by health-conscious consumers, cutting-edge drug delivery innovations, and significant investments from companies like Lonza.

RECENT DEVELOPMENTS & NEWS

Recent developments in the market include the introduction of plant-based formulations, such as Roquette’s LYCAGEL Flex hydroxypropyl pea starch premix in May 2024, which enhances both functionality and sustainability. In April 2024, Lupin Ltd launched the first U.S. generic doxycycline capsule, highlighting the growing focus on affordable pharmaceuticals. There's also an uptick in research and development for biopolymers and capsule delivery systems to meet the demand for targeted drug release and eco-friendly sourcing. Nutraceuticals and cosmeceuticals are increasingly utilizing capsule formats for better dosage accuracy and user-friendly delivery, while key players are investing in scaling up manufacturing to keep pace with the rising global demand.

KEY PLAYERS

- ACG Associated Capsules Pvt. Ltd.

- Bright Pharma Caps Inc.

- CapsCanada Corporation

- HealthCaps India Limited

- Lonza Group AG

- Medicaps Limited

- Qualicaps Co. Ltd. (Mitsubishi Chemical Holdings Corporation)

- Nectar Lifesciences Limited

- Roxlor LLC

- Shanxi Guangsheng Medicinal Capsules Co. Ltd

- Snail Pharma Industry Co. Ltd

- Suheung Co. Ltd

- Sunil Healthcare Limited

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5187&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: +1-631-791-1145