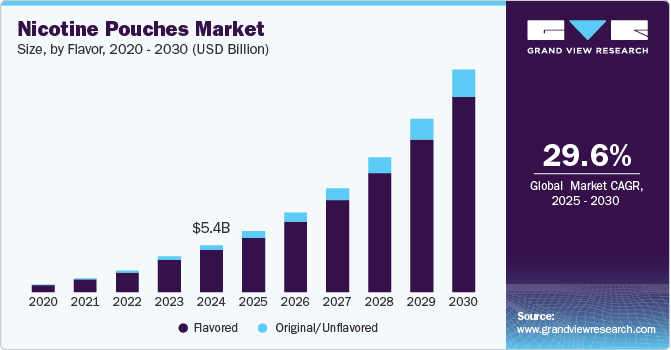

The global nicotine pouches market was valued at USD 5.39 billion in 2024 and is projected to expand at a compound annual growth rate (CAGR) of 29.6% from 2025 to 2030. Increasing interest among younger consumers seeking to quit smoking, along with the rising demand for smoke-free alternatives, is expected to be a key growth driver during this period.

In March 2022, Rutgers, one of the top public research universities in the United States, released a report examining consumer awareness and interest in nicotine pouches among American smokers. The survey, which included responses from 1,018 U.S. smokers, revealed that 29% were aware of nicotine pouches, 6% had tried them, and 17% expressed interest in doing so.

The expansion of online retail platforms offering nicotine pouches has made access to these products easier for consumers seeking safer alternatives to smoking. This trend supported the market’s growth in 2023 and is anticipated to continue through the forecast period. Demand for nicotine products that avoid the harmful effects of combustion and inhalation is on the rise. According to the Centers for Disease Control and Prevention (CDC), U.S. sales of nicotine pouches surged 300-fold from 2016 to 2021.

Leading companies, including British American Tobacco and Swedish Match, have seen rapid growth in their modern oral nicotine product lines in the U.S. between 2020 and 2021. For example, Swedish Match reported a 50% increase in U.S. sales of its ZYN nicotine pouch line during the first half of 2021. Additionally, company data shows that ZYN shipments reached 173.9 million cans in 2021, compared to 114.1 million cans in 2020.

A 2023 article by Boltbe, a nicotine pouch manufacturer, highlighted the growing popularity of nicotine pouches as a smokeless way to satisfy nicotine cravings. These small, flavored, and discreet pouches are becoming more appealing due to effective marketing strategies, wide availability, and prevailing social trends. Their presence on social media platforms has significantly boosted demand, with influencers and content creators shaping public perception. For instance, influencers such as DJ D’vey and model Billie-Jean Blackett have featured Velo nicotine pouches in their posts, presenting them as trendy lifestyle accessories. Platforms like Instagram serve as a "digital echo chamber," reinforcing these trends among specific audiences.

Get a preview of the latest developments in the Global Nicotine Pouches Market! Download your FREE sample PDF today and explore key data and trends

Regional Insights

North America led the global market in 2024, accounting for 78.4% of total revenue. The region is expected to see strong growth through the forecast period, driven by investments in tobacco alternatives and a shift in consumer preference toward nicotine patches, gums, and lozenges. Increased adoption among adult smokers in the U.S. and Canada, especially within lower-income groups and younger demographics, is a major factor fueling regional demand. Many consumers perceive nicotine pouches as less harmful than traditional tobacco products, further boosting their appeal.

Leading Companies in the Nicotine Pouches Market:

These key players dominate the market and shape industry trends:

-

British American Tobacco PLCO

-

Altria Group, Inc.

-

NIQO Co. (Swedish Match AB)

-

Nicopods ehf.

-

SnusCentral

-

Japan Tobacco International

-

Swisher

-

GN Tobacco Sweden AB

-

Skruf Snus AB

-

Tobacco Concept Factory

Gather more insights about the market drivers, restrains and growth of the Nicotine Pouches Market