The global sugar substitutes market size was estimated at USD 7.01 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. Key factors driving market growth include the changing consumer preferences for healthier and low-calorie foods. This can be considered as a response to rising prevalence of as well as awareness about obesity-related issues derived mainly from diabetes, cardiovascular diseases, and high cholesterol levels. Moreover, the fear of an increasing number of animal-borne diseases has raised health concerns among populations worldwide, resulting in reduced intake of animal products.

The awareness regarding plant-based sugar substitutes is growing due to their acknowledged health advantages, which include the potential prevention of non-communicable diseases, digestive problems, and obesity. Low-calorie sweeteners (LCSs) are sugar substitutes that have a higher sweetening effect for each gram than sugar compared to sweeteners with higher calorie counts. LCSs are found in various foods and beverages, including gums, frozen desserts, gelatins, candy, baked goods, breakfast cereals, pudding, and yogurt. Sugar substitutes can be used in the food and beverage industries without compromising taste or quality. They are becoming increasingly popular as people are now more aware of fitness, health, appearance, and body image than earlier.

Gather more insights about the market drivers, restrains and growth of the Global Sugar Substitutes Market

Detailed Segmentation:

Type Insights

The high-intensity sweeteners segment led the market with a revenue share of 70.41% in 2023. High-intensity sweeteners have a much higher sweetness than table sugar (sucrose), so fewer sweeteners are required to achieve the same sweetness. The growing health and wellness trend globally is expected to boost the application scope of high-intensity sweetness. The low-intensity sweeteners segment is expected to witness substantial growth from 2024 to 2030 due to the increasing consciousness about oral health. Many low-intensity sugar substitutes do not cause tooth decay as they do not leave a residual of enamel-degrading acid as sugar does.

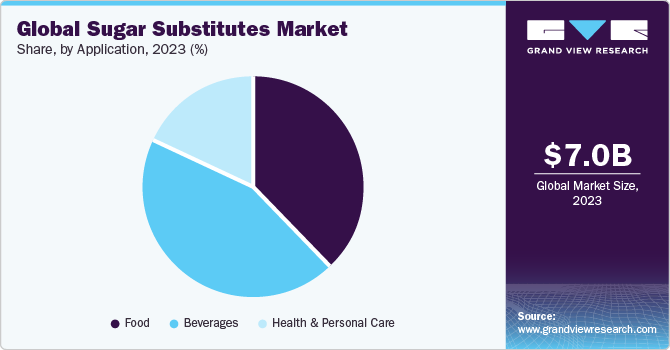

Application Insights

The beverage segment held the largest share of 44.27% in 2023. This was due to the growing demand for low as well as no-calorie formulations among consumers. Furthermore, the market for sugar substitutes, particularly natural sweeteners derived from monk fruit, agave, and stevia, is anticipated to grow as consumers are more inclined toward organic, natural, convenient, and functional beverages. In addition, rising demand for sports and health drinks with enhanced nutritional value is expected to boost market growth.

Regional Insights

North America dominated the global industry with the largest revenue share in 2023 due to high awareness of the adverse effects of sugar, the advantages of its substitutes, and high per capita income levels in the region. In addition, the regional market has grown due to supportive government initiatives. For instance, the FDA has allowed the use of high-intensity sweeteners like aspartame, saccharin, acesulfame potassium (Ace-K), advantame, and neotame, which has increased the demand for sugar substitutes. Moreover, American consumers look for calorie-free sweeteners derived from plants due to increased awareness.

Browse through Grand View Research's Consumer Goods Industry Research Reports.

- Fox Nuts Market: The global fox nuts market size was valued at USD 44.4 billion in 2023 and is projected to grow at a CAGR of 11.9% from 2024 to 2030.

- Makeup Remover Market: The global makeup remover market size was valued at USD 1.74 billion in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030.

Key Sugar Substitutes Company Insights

- The global sugar substitutes market comprises many major companies operating on regional and global levels. Leading market players are focusing on new product development through significant R&D expenditures, utilizing innovative technologies to manufacture products of the finest quality at the most affordable prices. Some of the initiatives taken are:

- In March 2022, Cargill introduced its stevia products with EverSweet + ClearFlo technology along with a more refined flavor. This innovative sweetener system combines stevia sweetener with a distinct flavor and offers a number of advantages, including flavor modification, improved dispersion, increased solubility and stability in compositions

- In April 2022, Tate & Lyle expanded allulose production to fulfill an elevated sharp rise in crystalline allulose demand, that gained prominence after the FDA settled for excluding it from the added and total sugar declarations on the panel of Nutrition Facts. As per Tate & Lyle, allulose has been utilized in a variety of products, with bars as the most popular

Key Sugar Substitutes Companies:

The following are the leading companies in the sugar substitutes market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these sugar substitutes companies are analyzed to map the supply network.

- Tate & Lyle

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Ingredion Incorporated

- Roquette Freres

- Ajinomoto Co.

- JK Sucralose Inc.

- The NutraSweet Company

- PureCircle

- I. DuPont De Nemours

Order a free sample PDF of the Sugar Substitutes Market Intelligence Study, published by Grand View Research.