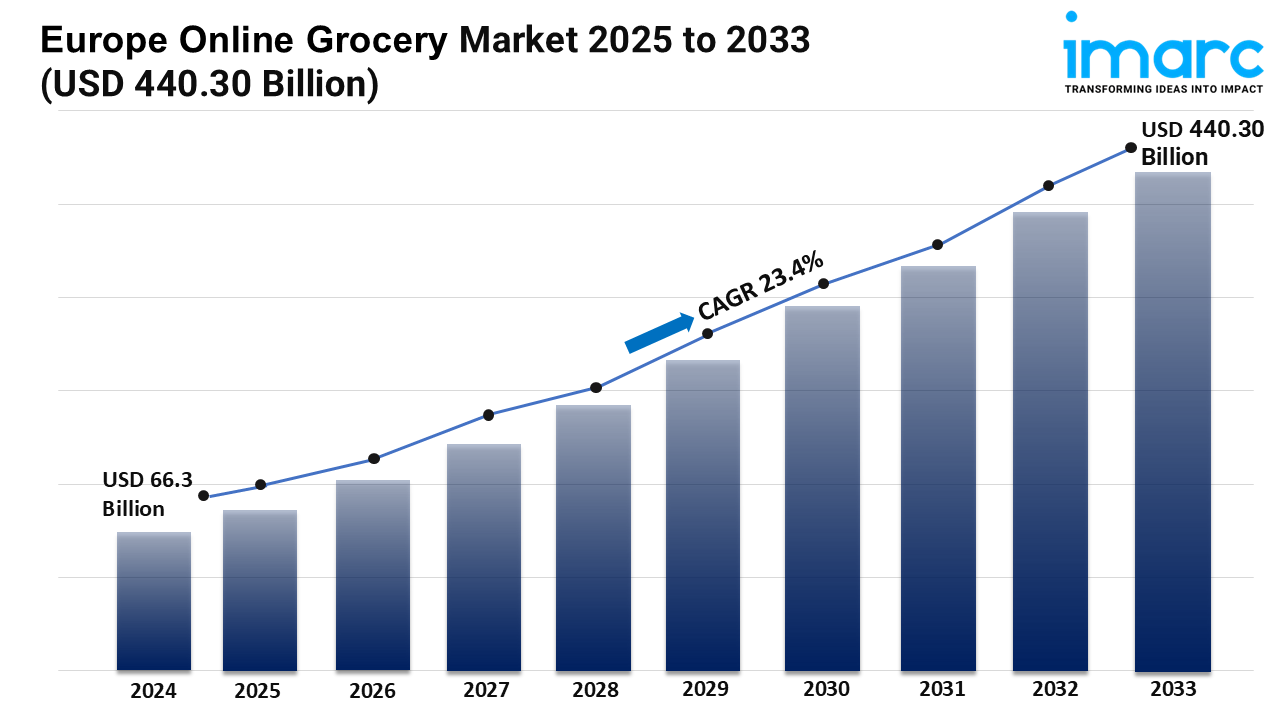

Europe Online Grocery Market Forecast by 2033

Market Size in 2024: USD 66.3 Billion

Market Forecast in 2033: USD 440.30 Billion

Market Growth Rate 2025-2033: 23.4%

The Europe online grocery market is rocketing from USD 66.3 billion in 2024 to a projected USD 440.30 billion by 2033, powered by a blistering compound annual growth rate of 23.4%. Convenience-seeking shoppers, friction-free mobile apps, and expanding same-day delivery footprints are converging to make digital grocery baskets the fastest-growing retail channel on the continent.

Growth Drivers Steering the European Online Grocery Market

Surging Internet & Smartphone Penetration Across the EU

Eurostat’s 2024 Digital Economy Report says that 77% of people in Europe ordered things or services on the internet in the last year. This went up from only 59% in 2014. So, that is a jump of 17% over ten years. This was helped by the spread of 5G and cheaper data for phones. Now, mobile-first apps make a big part of all grocery buys. Also, super-apps like Flink, Gorillas, and Uber Eats let people get food, pharmacy, and small everyday products with just one tap. Because of this, places like villages in Spain and Poland now have people placing food orders online every week. In fact, from 2021 to 2024, these areas saw online grocery buys go up from 8% to 31%, National Postal Tracker data says.

Retailer-Led Logistics & Dark-Store Expansion

Deliveroo reached a big goal in August 2024. It made its first half-year profit of £1 million. Most of this came from people getting groceries and shopping items delivered all over Europe. The company used small "dark stores" to speed up deliveries in London, Paris, and Berlin. Now, most orders arrive in less than 20 minutes. Tesco started working with a start-up called Starship Technologies in 2024. Starship Technologies uses robots to deliver the last part of an order in Milton Keynes and Northampton. This has helped to cut down traffic in busy areas and made each delivery cost 18% less. These new ideas are making people want their orders quicker than ever, going from getting them the next day to getting them within an hour. So, leading delivery platforms are now seeing more than 70% of customers come back to buy again.

Health, Sustainability, and Premiumisation Trends

In 2023, people in Europe spent €5.4 billion on plant-based foods. This was up by 5.5% compared to the year before, as reported by the Smart Protein Project. Online stores are making the most of this. They now have special places called “green aisles” where you can find organic, gluten-free, and locally grown foods with clear carbon labels. In November 2024, Rohlik, which is a Czech online store, joined with Amazon. They started a “Farm-to-Table in 24 h” offer in Germany. It promises that food will be picked in the morning and gets to you the same day. This lets Amazon use its Prime delivery network. The goal is to lower food miles and waste. This has brought in shoppers who care about the planet. They are happy to pay up to 12% more for goods that are proven to be better for Earth.

Request a Free Sample Report: https://www.imarcgroup.com/europe-online-grocery-market/requestsample

Europe Online Grocery Market Segmentation

Analysis by Product Type

- Vegetables and Fruits

- Dairy Products

- Staples and Cooking Essentials

- Snacks

- Meat and Seafood

- Others

Analysis by Business Model

- Pure Marketplace

- Hybrid Marketplace

- Others

Analysis by Platform

- Web-Based

- App-Based

Analysis by Purchase Type

- One-Time

- Subscription

Country Analysis

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape

Flink, Just Eat, Delivery Hero, Uber Eats, Doordash, Amazon Inc., Rewe, Rakuten Group, Inc, Tesco, Carrefour, etc.

Europe Online Grocery Market News

- April 2025: JD.com soft-launched its grocery platform Joybuy in London zones 1–3, offering same-day delivery of 8,000 SKUs with free shipping on first-time orders.

- March 2025: TikTok Shop expanded grocery categories into Germany, France, and Italy, leveraging live-stream “shoppertainment” to target Gen-Z shoppers.

- March 2025: Marks & Spencer partnered with Rohlik Group to roll out 500 M&S Food products online across Czechia, Austria, Germany, Hungary, and Romania.

- February 2025: Prosus finalised an all-cash USD 4.4 billion takeover of Just Eat Takeaway.com, unifying two of Europe’s largest food-delivery ecosystems.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.