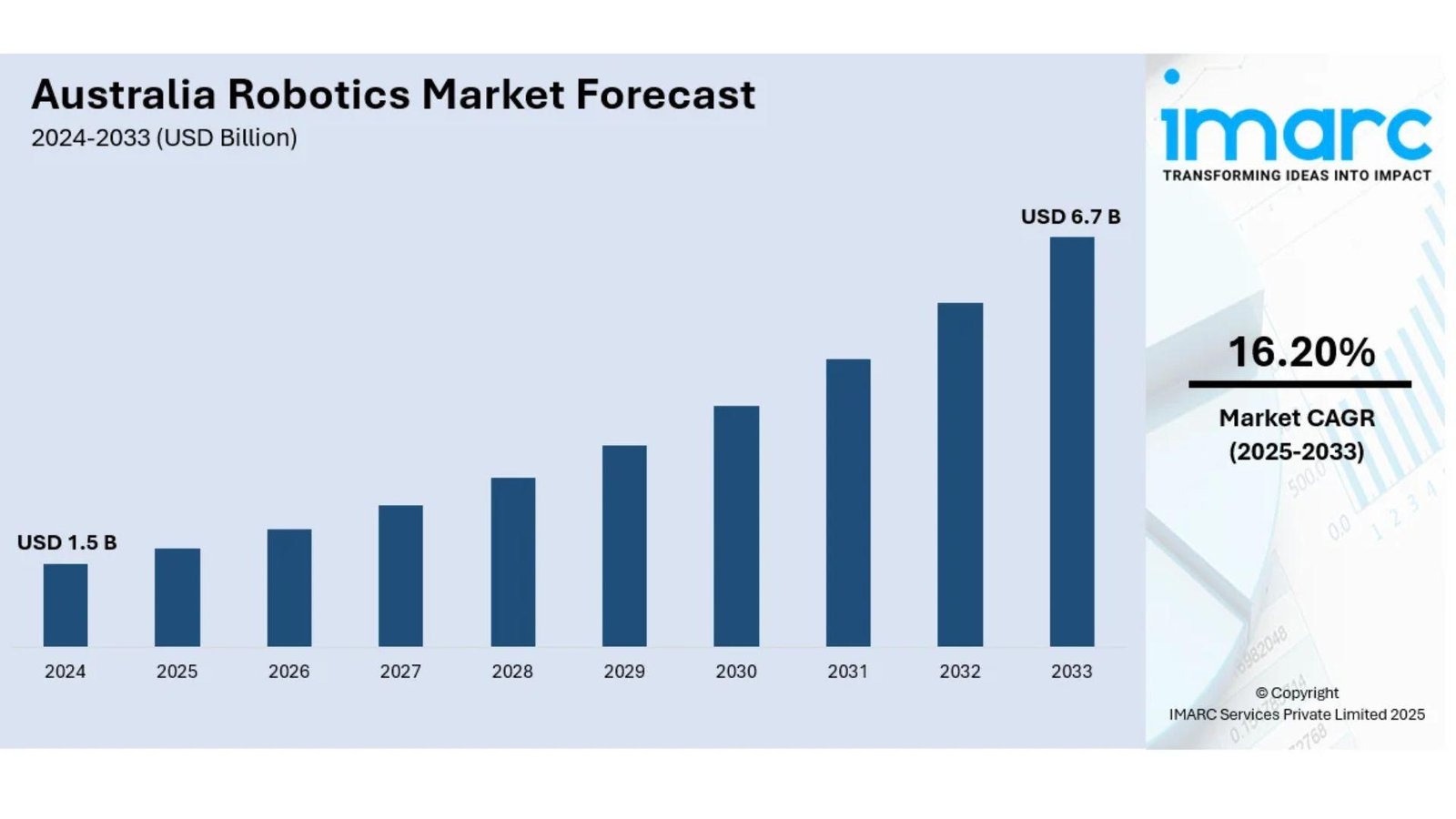

The latest report by IMARC Group, titled “Australia Robotics Market Size, Share, Trends and Forecast by Product Type and Region, 2025-2033,” offers a detailed analysis of the robotics sector's growth in Australia, spanning industrial automation, service robots, healthcare, logistics, mining, agriculture, and AI-enabled smart robotics applications. The Australia robotics market size reached approximately USD 1.5 Billion in 2024. Looking forward, IMARC Group expects the market to grow significantly to USD 6.7 Billion by 2033, exhibiting a compound annual growth rate (CAGR) of 16.20% during 2025–2033.

Report Attributes:

· Base Year: 2024

· Forecast Years: 2025–2033

· Historical Years: 2019–2024

· Market Size in 2024: USD 1.5 Billion

· Market Forecast in 2033: USD 6.7 Billion

· Market Growth Rate 2025–2033: 16.20%

For an in-depth analysis, you can refer to a sample copy of the report:

https://www.imarcgroup.com/australia-robotics-market/requestsample

Australia Robotics Market Overview

- Growing industrial automation demand across manufacturing, mining, logistics, and agriculture sectors is a key growth driver.

- Increasing labor shortages and rising labor costs are prompting adoption of robotic automation to improve productivity and reduce operational errors.

- Government incentives and Industry 4.0 initiatives, such as the Modern Manufacturing Strategy and Advanced Manufacturing Growth Centre (AMGC), support adoption especially among SMEs.

- Mining industry extensively uses robotics for hazardous and remote operations to enhance safety and efficiency, with investments in autonomous trucks and robotic inspection systems.

- Expansion of e-commerce is accelerating logistics automation, with robotics driving warehousing and last-mile fulfillment efficiency.

- Growing integration of artificial intelligence (AI) and sensor advancements are enabling smarter and more adaptable robotic systems.

Key Features and Trends

- Adoption of collaborative robots (cobots) is increasing, especially among SMEs for tasks requiring human-robot interaction, notably in food processing, packaging, and assembly.

- Development of AI-enabled smart robots enhances operational decision-making and predictive maintenance.

- Robotics integration in precision agriculture and healthcare supports productivity and innovative service delivery.

- Increased collaboration between public institutions, private companies, and research centers to pilot and deploy robotics solutions.

- Rising focus on digitalization and automation aligns with Australia's strategic goal to transform manufacturing competitiveness.

Growth Drivers

- Labor shortages and aging workforce pushing robotic automation adoption.

- Industry 4.0 and digital transformation strategies driving technology investment.

- Government incentives, grants, and funding programs encouraging robotics deployment.

- Technological advances in AI, machine learning, and sensors improving robot capabilities.

- Rising demand for operational efficiency, precision, and safety in manufacturing and mining.

Innovation & Market Demand

- Development of cobots with user-friendly interfaces and easy deployment.

- Autonomous robotic systems for mining and logistics operations reducing human risk exposure.

- AI integration enabling real-time data collection, analytics, and proactive maintenance.

- Expansion of service robotics in healthcare and domestic applications.

- Increasing adoption of robotic process automation (RPA) in sectors like finance and administration.

Australia Robotics Market Opportunities

- Expansion in emerging sectors such as healthcare robotics and smart agriculture.

- SMEs adopting affordable collaborative robots to compete globally.

- Government Industry 4.0 initiatives and funding opportunities supporting widespread adoption.

- Growing interest in AI-powered robotics for logistics and e-commerce automation.

- Regional growth in mining hubs and manufacturing clusters.

Australia Robotics Market Challenges

- High initial investment cost and technology integration complexity.

- Skills gap hindering broader adoption and effective utilization of robotics.

- Regulatory and safety compliance requirements for robotic deployments.

- Resistance to change within traditional industries adopting automation.

- Supply chain constraints impacting availability of advanced robotic components.

Australia Robotics Market Analysis

- The market is transforming rapidly with high growth in robotic units and intelligent automation solutions.

- SMEs are a growing adopter segment, fueling demand for collaborative and easily integrable robots.

- Manufacturing, mining, logistics, and healthcare dominate application sectors.

- Regional hubs like New South Wales, Victoria, Queensland, and Western Australia show significant activity.

- Key players and new entrants focus on innovation, partnerships, and service models to capture market share.

Australia Robotics Market Segmentation:

- By Product Type:

- Industrial Robots (Articulated, Cartesian, SCARA, Cylindrical, Others)

- Service Robots (Personal/Domestic, Professional)

- By Application:

- Manufacturing and Industrial Automation

- Mining and Construction

- Healthcare and Medical

- Agriculture and Precision Farming

- Logistics and Warehousing

- Others

- By Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Robotics Market News & Recent Developments

- In 2024, Brisbane-based start-up Australian Droid and Robot (ADR) secured USD 2 million investment to scale mine-monitoring robots used in harsh environments.

- Government-backed funding programs like the Defence Industry Development Grant promote robotics innovation for defense and manufacturing sectors.

- Increasing pilot programs and testbeds for AI-integrated robotics in agriculture and healthcare.

Australia Robotics Market Key Players

- ABB Australia

- FANUC Australia

- KUKA Robotics

- Yaskawa Motoman

- Australian Droid and Robot (ADR)

- Other international and local robotics technology providers and integrators.

Key Highlights of the Report:

- Market Performance (2019–2024)

- Market Outlook (2025–2033)

- Impact of Government Incentives and Industry 4.0

- Adoption Trends for Collaborative Robots

- Sectoral Analysis: Manufacturing, Mining, Healthcare, Agriculture

- Technological Innovations and AI Integration

- SWOT Analysis

- Competitive Landscape and Strategic Positioning

- Regional Market Insights

- Strategic Recommendations

Note:

If you require additional information or tailored analysis beyond the scope of this report, customized research options are available.

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=32682&flag=E

FAQs: Australia Robotics Market

Q1: What is the forecast CAGR for the Australia robotics market during 2025–2033?

A: Approximately 16.20%.

Q2: What was the market size in 2024?

A: Approximately USD 1.5 Billion.

Q3: Which sectors are driving robotics market growth?

A: Manufacturing, mining, logistics, healthcare, and agriculture.

Q4: What are the key technological trends in the market?

A: Increased adoption of collaborative robots, AI integration, autonomous systems, and sensor advancements.

Q5: Who are the major players in the Australia robotics market?

A: ABB, FANUC, KUKA Robotics, Yaskawa, Australian Droid and Robot, and other major robotics providers.

About Us:

IMARC Group is a leading market research company providing management strategy and market research worldwide. We partner with clients across sectors and regions to identify high-value opportunities, address critical challenges, and transform businesses through comprehensive market intelligence, custom consulting, and actionable insights aimed at sustainable growth.

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302