Market Overview 2025-2033

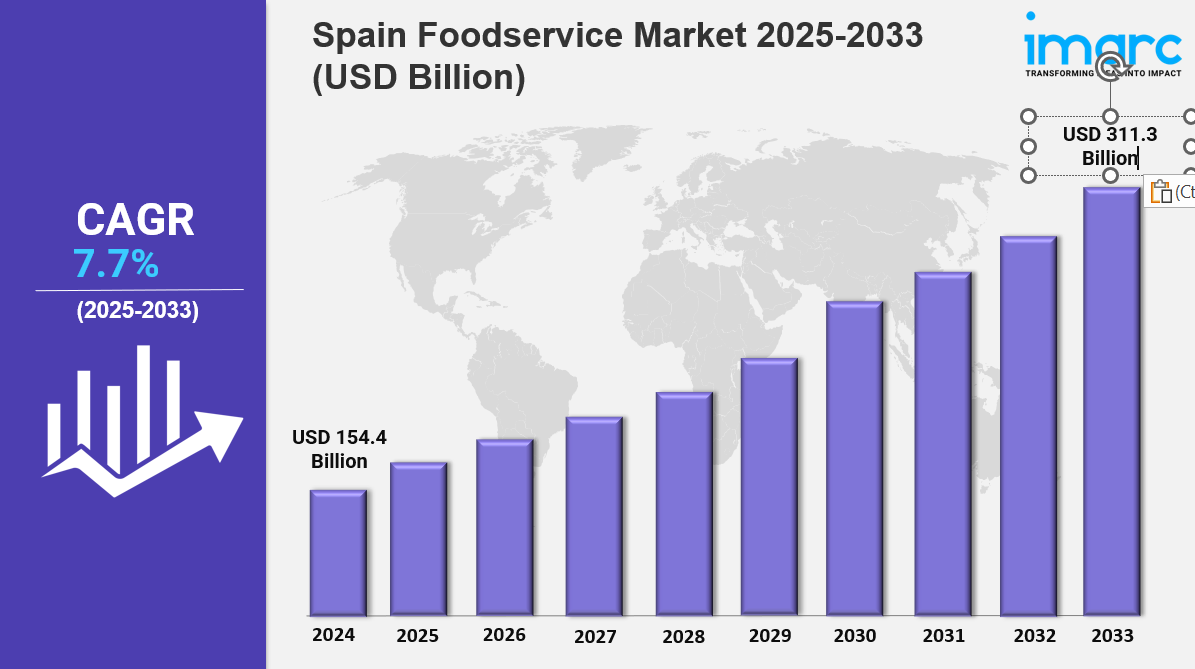

The Spain foodservice market size reached USD 154.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 311.3 Billion by 2033, exhibiting a growth rate (CAGR) of 7.7% during 2025-2033. The market is expanding due to a resurgence in international tourism, evolving consumer dining preferences, and the adoption of digital ordering platforms. Growth is driven by health-conscious menus, sustainability initiatives, and the rise of cloud kitchens. With increasing demand for diverse culinary experiences, the industry is becoming more dynamic, innovative, and competitive.

Key Market Highlights:

✔️ Strong market growth driven by increasing tourism and evolving dining preferences

✔️ Rising demand for fast-casual, health-conscious, and delivery-focused foodservice models

✔️ Expanding digital integration for reservations, ordering, and customer engagement across restaurants and cafes

Request for a sample copy of the report: https://www.imarcgroup.com/spain-foodservice-market/requestsample

Spain Foodservice Market Trends and Drivers:

The Spain foodservice market is undergoing a transformative shift, fueled by a surge in health-conscious dining and evolving consumer values. In the post-pandemic era, Spanish consumers are increasingly prioritizing nutritional transparency, organic ingredients, and plant-based alternatives. This trend has compelled restaurants to redesign their menus with wellness-driven options, such as allergen-free dishes, low-calorie meals, and sustainably sourced produce. As of 2024, sales of plant-based proteins have surged by 18% year-over-year, underscoring the growing popularity of flexitarian diets across Spain.

Fast-casual outlets like Veggie Garden and Green & Go are expanding their footprint within the Spain foodservice market, offering protein-rich legume bowls and customizable vegan meals. Even traditional establishments are adapting, now offering vegan patatas bravas and gluten-free croquetas. However, rising ingredient costs and sustainability demands pose challenges, especially for smaller operators. To navigate this, many have partnered with local organic farms—strengthening supply chains and bolstering appeal among eco-conscious diners. Digital innovation is another key force reshaping the Spain foodservice market size and consumer engagement models. In 2024, mobile app orders accounted for 34% of all restaurant sales, with platforms like Glovo and Deliveroo expanding into tier-2 cities such as Valencia and Seville.

The rise of cloud kitchens—dedicated to delivery-only operations—has reduced overheads by up to 40%, offering a scalable solution for new entrants. Meanwhile, AI-powered features like dynamic pricing and personalized menu suggestions are becoming standard. Madrid-based La Tagliatella, for example, reported a 22% increase in average order value after implementing ChatGPT-powered chatbots for upselling. These advancements are contributing to a more competitive landscape, prompting legacy restaurants to embrace digital loyalty programs and hybrid service models.

QR code-guided tasting menus and augmented reality dining experiences are emerging as differentiators, further expanding the Spain foodservice market share in tech-driven segments. Sustainability has become non-negotiable, influencing both consumer behavior and operational practices across the Spain foodservice market. In 2024, 72% of diners reported a preference for restaurants demonstrating tangible environmental responsibility. Zero-waste kitchens, biodegradable packaging, and carbon-neutral certifications are now industry benchmarks. Pioneering restaurants like Barcelona’s Silo have adopted closed-loop systems, reusing or composting 98% of waste. Spain’s 2023 Single-Use Plastics Ban has added regulatory pressure, accelerating the shift toward sustainable alternatives.

Major hospitality groups such as Meliá have committed to sourcing at least 60% of ingredients from within a 100-km radius, reducing transport emissions and reinforcing local supply chains. Startups like Too Good To Go are also redefining surplus management by helping cafes and bakeries sell leftover food at a discount, increasing both revenue and environmental goodwill. These green initiatives are proving to be commercially viable—sustainable restaurants saw a 15% higher customer retention rate in 2024, a key driver of Spain foodservice market share growth.

The current landscape of the Spain foodservice market is a complex blend of tradition and innovation. While time-honored culinary staples like tapas and regional dishes remain deeply rooted in Spanish culture, demographic shifts and globalization are reshaping consumption patterns. Rapid urbanization has led to rising demand for quick-service formats, with 24% of Madrid's workforce subscribing to lunchtime meal services like Landal. Simultaneously, tourism—rebounding to 85 million visitors in 2024—is catalyzing demand for high-end dining, especially in coastal hotspots like Costa del Sol.

However, economic pressures have driven mid-tier restaurants to introduce value-driven offerings such as fixed-price menús del día, featuring locally sourced ingredients. While digitization enhances efficiency, it also raises questions around job security, as 12% of labor-intensive roles have been automated since 2022. As operators look toward the future, success in the Spain foodservice market will hinge on their ability to balance culinary authenticity with digital transformation, sustainability, and personalized nutrition—cornerstones of a competitive and resilient Spain foodservice market outlook.

Spain Foodservice Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest United States healthcare discount plan market report. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Type:

- Cafes and Bars

- By Cuisine

- Bars and Pubs

- Cafes

- Juice/Smoothie/Desserts Bars

- Specialist Coffee and Tea Shops

- Cloud Kitchen

- Full Service Restaurants

- By Cuisine

- Asian

- European

- Latin American

- Middle Eastern

- North American

- Others

- Quick Service Restaurants

- By Cuisine

- Bakeries

- Burger

- Ice Cream

- Meat-based Cuisines

- Pizza

- Others

Breakup by Outlet:

- Chained Outlets

- Independent Outlets

Breakup by Location:

- Leisure

- Lodging

- Retail

- Standalone

- Travel

Breakup by Region:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145