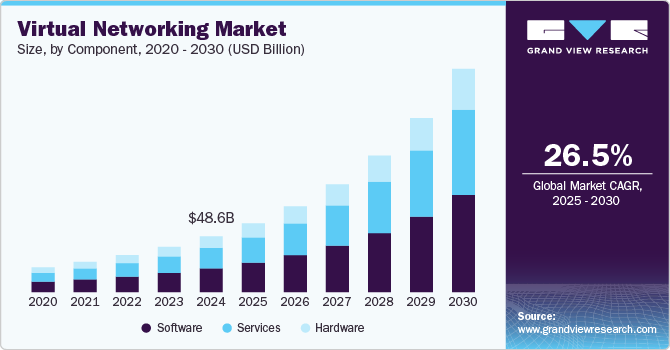

The global virtual networking market size is estimated at USD 194.63 billion in 2030 and is projected to grow at a CAGR of 26.5% from 2025 to 2030, according to a new report by Grand View Research, Inc. Factors such as the growing adoption of Internet-of-Things (IoT) devices, the need for improved network security, the growing adoption of cloud computing, and the rising demand for remote working are the major factors driving the market growth. As more businesses move their applications and infrastructure to the cloud, there is a growing need for virtual networking solutions that can provide secure, high-performance connectivity between different cloud environments.

Integration of virtual switches with Software-defined Networking (SDN) controllers are also expected to drive the demand for the Virtual Networking Market growth. Virtual switches are increasingly being integrated with SDN controllers, which provide centralized management and control of the network infrastructure. This allows for greater flexibility and agility in managing virtual networks and can simplify the deployment of network services such as firewalls, load balancers, and intrusion detection/prevention systems. At the same time, virtual switches are being integrated with cloud orchestration platforms such as Kubernetes and OpenStack, which allow for automated provisioning and management of virtual networks.

Cloud computing and virtual networking solutions are closely interconnected, as virtual networking is an essential component of cloud infrastructure. Cloud computing with virtual networking solutions allows businesses to create a flexible and scalable network infrastructure that can meet the needs of modern applications and workloads. In cloud computing, virtual networking solutions can provide improved performance, reliability, and cost savings compared to traditional networking solutions. By leveraging virtual networking solutions in the cloud, businesses can achieve greater efficiency, agility, and scalability in their IT operations, while also improving security and reducing costs associated with hardware and maintenance

The outbreak of the COVID-19 pandemic had a positive impact on the market. The COVID-19 pandemic has had a significant impact on the adoption and usage of virtual networking solutions, as more businesses and individuals work remotely and rely on cloud-based services. With remote work becoming more prevalent, there is greater emphasis on data security and privacy, driving demand for virtual networking solutions that can provide advanced security features such as encryption, access control, and intrusion detection/prevention. Such factors are anticipated to create more demand for the market over the coming years.

Get a preview of the latest developments in the Virtual Networking Market! Download your FREE sample PDF today and explore key data and trends

Virtual Networking Market Report Highlights

- The software segment accounted for the largest revenue share of 42.67% in 2024

- The cloud segment held the largest revenue share in 2024. As organizations are increasingly adopting cloud computing, they are also looking to leverage the benefits of virtual networking in the cloud, such as flexibility, scalability, and cost-effectiveness

- The large enterprise segment dominated the market in 2024. Large enterprises across the globe are increasingly adopting cloud-based solutions and infrastructures to increase their scalability.

- The IT & telecommunication segment dominated the market in 2024. The ability of virtual networking solutions to offer better flexibility, cost savings, and scalability is a major factor driving segment growth

- The North America virtual networking market held a significant revenue share in 2024

Key Virtual Networking Company Insights

Some key companies in the virtual networking industry include Huawei Technologies Co., VMware, Inc., IBM Corporation, Citrix Systems, Inc., Verizon Communications Inc., and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

- Verizon Communications Inc. is a telecommunication company headquartered in New York, U.S. Its offering in the market includes software-defined networking (SDN) and network functions virtualization (NFV). These technologies enable more efficient and flexible network management, catering to the growing demand for cloud-based services and digital transformation among enterprises.

- VMware, Inc. is a virtualization and cloud computing company. The company specializes in software-defined networking (SDN) and network functions virtualization (NFV), which are critical for modern data center operations and cloud environments. VMware's flagship product, VMware Cloud Foundation, integrates various services, including vSAN for storage and NSX for networking, providing a comprehensive platform for private cloud deployments.

List of Key Payers in the Virtual Networking Market

- Huawei Technologies Co., Ltd.

- Hewlett Packard Enterprise Development LP

- VMware, Inc.

- Cisco Systems, Inc

- Microsoft Corporation

- IBM Corporation

- Citrix Systems, Inc.

- Juniper Networks, Inc.

- Oracle

- Verizon Communications Inc.

Gather more insights about the market drivers, restrains and growth of the Virtual Networking Market