Significant Growth Driven by Rising Digital Transactions and Enhanced Security Measures

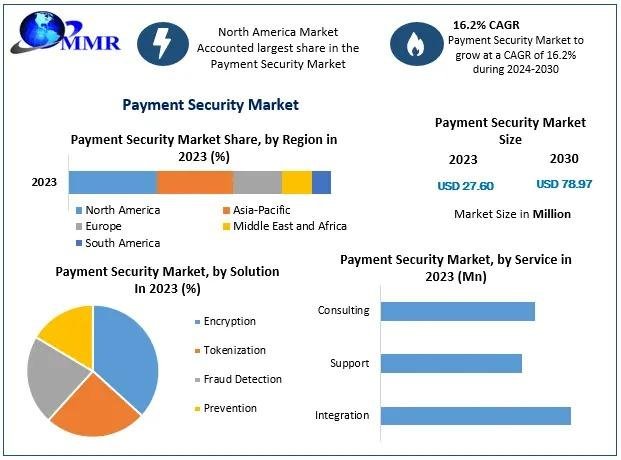

Payment Security Market Size is experiencing substantial growth, with projections indicating an increase from USD 27.60 million in 2023 to USD 78.97 million by 2030, reflecting a compound annual growth rate (CAGR) of 16.2% during this period.

Market Estimation & Definition

Payment security refers to the implementation of security protocols by merchants to mitigate the risk of payment fraud. As digital transactions become increasingly prevalent, the necessity for robust payment security solutions has intensified. These solutions encompass various technologies and practices designed to protect sensitive financial information from threats such as identity theft and payment fraud.

Market Growth Drivers & Opportunities

Several key factors are propelling the expansion of the payment security market:

- Increasing Frequency of Data Breaches: The rising number of data breaches has led to significant financial losses, underscoring the critical need for effective payment security solutions to protect sensitive information.

Get Your Free Sample Explore the Latest Market Insights: https://www.maximizemarketresearch.com/request-sample/24755/

- Regulatory Compliance: Adherence to standards such as the Payment Card Industry Data Security Standard (PCI DSS) mandates the implementation of stringent security measures, driving the adoption of advanced payment security solutions.

- Growing End-User Awareness: Increased awareness among consumers and businesses regarding the importance of payment security has led to a higher demand for secure transaction methods.

- Government Initiatives Promoting Cashless Payments: Various government efforts to encourage cashless transactions have necessitated the adoption of secure payment systems to ensure the safety and integrity of digital payments.

- Advancements in Mobile Commerce: The proliferation of smartphones and wireless networks has facilitated mobile commerce, increasing the demand for mobile payment security solutions to safeguard transactions conducted via mobile devices.

Segmentation Analysis

The payment security market is segmented based on solution, organization size, and region.

- Solution:

- Encryption: This solution involves converting sensitive data into a coded format, ensuring that only authorized parties can access the information. Encryption is fundamental in protecting data during transmission and storage.

For More Detailed Visit: https://www.maximizemarketresearch.com/market-report/global-payment-security-market/24755/

- Tokenization: Tokenization replaces sensitive data with unique identification symbols (tokens) that retain essential information without compromising security. This method is widely used to protect credit card information during transaction processing.

- Fraud Detection and Prevention: These solutions employ advanced analytics and machine learning to identify and mitigate fraudulent activities in real-time, safeguarding both merchants and consumers.

- Organization Size:

- Large Enterprises: Large organizations often handle vast amounts of sensitive data and are prime targets for cyber-attacks. Consequently, they invest heavily in comprehensive payment security solutions to protect their operations and customer information.

- Small and Medium-sized Enterprises (SMEs): SMEs are increasingly adopting payment security solutions as digital transactions become integral to their operations. Scalable and cost-effective security measures are essential for this segment to protect against potential threats.

Country-Level Analysis

United States:

The U.S. leads the payment security market, driven by a mature digital economy and a high adoption rate of advanced payment technologies. The presence of major market players and stringent regulatory frameworks further bolster the implementation of comprehensive payment security solutions across various industries.

Germany:

Germany exhibits significant growth potential in the payment security market, attributed to its strong economy and increasing digital payment adoption. The country's emphasis on data privacy and compliance with stringent European Union regulations, such as the General Data Protection Regulation (GDPR), necessitates robust payment security measures.

FREE |Get a Copy of Sample Report Now: https://www.maximizemarketresearch.com/request-sample/24755/

Competitive Analysis

The payment security market is highly competitive, with key players focusing on innovation and strategic partnerships to enhance their offerings. Notable companies in this space include:

- PayPal Holdings, Inc.: A global leader in online payment solutions, PayPal offers advanced security features, including encryption and fraud detection, to ensure secure transactions for its users.

- Mastercard Incorporated: Beyond its payment processing services, Mastercard provides comprehensive security solutions, such as tokenization and biometric authentication, to enhance transaction security.

- Fiserv, Inc.: Fiserv delivers a range of payment security services, including fraud detection and prevention solutions, catering to financial institutions and merchants.

- Symantec Corporation: Specializing in cybersecurity, Symantec offers encryption and data loss prevention solutions that are integral to securing payment information.

- Trend Micro Incorporated: This company provides advanced threat detection and prevention solutions, safeguarding payment systems against evolving cyber threats.

For additional reports on related markets, visit our website:

AI Recruitment Market Size Outlook

Virtual Data Storage Market Size Outlook

Conclusion

The global payment security market is poised for substantial growth, driven by the increasing adoption of digital payment methods and the imperative to protect sensitive financial information. As cyber threats become more sophisticated, the demand for advanced payment security solutions will continue to rise, ensuring secure and seamless transactions across industries.

About Maximize Market Research

Maximize Market Research is a rapidly expanding market research and business consulting firm with a global client base. Our growth-oriented research strategies and focus on driving revenue impact have established us as a trusted partner to many Fortune 500 companies. With a diverse portfolio, we cater to a wide range of industries, including IT telecommunications, chemicals, food beverages, aerospace defense, healthcare, and more.