The global laboratory proficiency testing market size was estimated at USD 1.36 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2024 to 2030. Increasing focus on water testing, legalization of medical cannabis, growing number of cannabis testing laboratories, rising prevalence of foodborne illnesses, growing cases of chemical contamination of foods, and continuous introduction of new products & services are key factors expected to propel market growth. For instance, in March 2022, BIPEA launched a novel Proficiency Testing Scheme (PT 35d) dedicated to water microbiological testing laboratories. Moreover, the growing adoption of laboratory PT owing to stringent regulations is another factor estimated to boost market growth in the coming years.

Laboratory PT for endotoxin and pyrogen levels is crucial in water testing. Endotoxins are toxic components released from the outer membrane of certain bacteria, while pyrogens are substances that can cause fever and other adverse effects. PT ensures that laboratories accurately measure and assess endotoxin and pyrogen levels in water samples. It also verifies the laboratory’s competency in using appropriate testing methods, such as Limulus Amebocyte Lysate (LAL) assays, to detect and quantify these contaminants. Accurate endotoxin and pyrogen testing are vital for evaluating safety and quality of water, especially for pharmaceutical production, medical device manufacturing, and dialysis. PT in this area guarantees reliable and consistent results, enabling informed decisions to protect public health and ensure regulatory compliance in water-related industries.

Gather more insights about the market drivers, restrains and growth of the Global Laboratory Proficiency Testing Market

Global Laboratory Proficiency Testing Market Report Segmentation:

Industry Insights

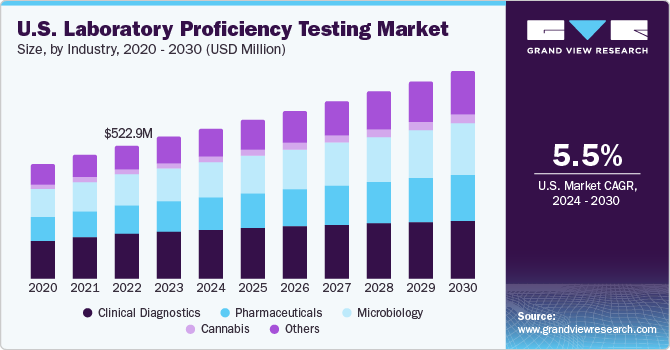

Clinical diagnostic segment held the largest market share of 33.32% in 2023. Clinical diagnostic laboratories have demonstrated a lower likelihood of diagnostic errors compared to hospitals, and PT has become widely adopted to maintain accurate results and effective quality management. Recognizing the significance of PT, the Centers for Medicare and Medicaid Services (CMS) have proposed updates to the requirements for laboratories regulated under CLIA in July 2022. These updates aim to enforce stricter standards, enhance accuracy & reliability in laboratory testing, and ensure that CLIA laboratories meet the highest quality benchmarks.

Technology Insights

Cell culture segment dominated the market with a revenue share of 27.05% in 2023 and is expected to maintain its dominance throughout the forecast period. With the increasing adoption of cell-culture-based products, such as monoclonal antibodies, there is a growing demand for cell culture tests to optimize the production of microbial strain cultures. PT in this field focuses on assessing the efficacy of laboratories and identifying contaminants & impurities present in cell cultures.Minerva Biolabs GmbH is a notable provider of proficiency tests that are specifically designed to evaluate common contaminants and test the laboratory's sensitivity to yeast/fungi, bacteria, and mycoplasmas

End-use Insights

Hospitals segment dominated the laboratory proficiency testing market with a revenue share of 31.61% in 2023 owing to the increasing need for regular competence evaluation in hospitals. Increasing number of tests offered by hospitals is further expected to drive the demand for PT. In September 2021, in Chandigarh, India, the government has taken steps to ensure the proficiency of outsourced staff in hospital laboratories, especially data entry operators. The Health Secretary introduced a computerized proficiency test conducted by SPIC for these personnel in government hospitals. This initiative aims to assess the competency and effectiveness of outsourced staff in data entry tasks, maintaining high standards of laboratory PT in the healthcare system.

Browse through Grand View Research's Clinical Diagnostics Industry Research Reports.

- Neglected Tropical Diseases Diagnosis Market: The global neglected tropical diseases diagnosis market size was estimated at USD 6.84 billion in 2024 and is projected to grow at a CAGR of 6.03% from 2025 to 2030.

- Multi Cancer Early Detection Market: The global multi cancer early detection market size was estimated at USD 1.12 billion in 2024 and is projected to grow at a CAGR of 17% from 2025 to 2030.

Regional Insights

North America dominated the market with a revenue share of 43.78% in 2023. This can be attributed to the developed healthcare system and high PT adoption rate. The well-established regulatory framework also prioritizes quality management in this region, which influences market growth positively. The wide availability of PT programs in this region is another reason for the greater market potential of laboratory testing in North America. Furthermore, stringent environmental and water safety norms are also propelling the demand for laboratory tests and, thus, laboratory proficiency tests.

Key Companies & Market Share Insights

Key market players are adopting market strategies, such as new product launches, collaborations, and geographical expansions, to increase their global footprint.

In April 2023, BIPEAunveiled PTS 110A, a new Proficiency Testing Scheme that enables testing laboratories to assess their analytical capabilities by analyzing a rice sample. This initiative can empower laboratories to evaluate and enhance their performance in rice sample analysis, driving excellence in the field.

In January 2023, BIPEA introduced a novel proficiency test in surface microbiology, expanding its range of offerings. This new test allows professionals in the field to enhance their expertise and proficiency in surface microbiology analysis.

Key Laboratory Proficiency Testing Companies:

- LGC Limited

- Bio-Rad Laboratories, Inc.

- Randox Laboratories Ltd.

- QACS - The Challenge Test Laboratory

- Merck KGaA

- Weqas

- BIPEA

- NSI Lab Solutions

- Absolute Standards, Inc.

- INSTAND

Order a free sample PDF of the Laboratory Proficiency Testing Market Intelligence Study, published by Grand View Research.