The global smart lighting market was valued at USD 15.05 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 22.1% from 2023 to 2030. The demand for smart lighting is fueled by its ability to connect with IoT devices, allowing users to create various lighting ambiances using smartphones or tablets. Smart lights can be dimmed to different color tones, scheduled for automatic operation, track energy usage, and connect via Wi-Fi, Bluetooth, SmartThings, Z-Wave, or ZigBee. They also offer voice-control options through integration with platforms like Google Assistant, Amazon Alexa, Apple Siri, and Microsoft Cortana. This versatility, alongside the growing adoption of IoT devices and voice-assistant platforms, has driven market growth for smart lighting.

Known as “connected lighting,” smart lighting integrates seamlessly with IT networks in buildings or city infrastructures to share operational data. For example, smart streetlights in city parking lots or roads enhance safety with wide coverage, environmental monitoring, parking and traffic management, and city surveillance by linking to IoT devices. With sensors integrated, smart lights become intelligent devices, collecting data on activity patterns, daylight, occupancy, and environmental factors like temperature and humidity. This information is crucial for government agencies to respond to city events and monitor for potential threats.

Gather more insights about the market drivers, restrains and growth of the Global Smart Lighting Market

Government policies encouraging energy conservation and environmental protection, as well as strict regulations discouraging incandescent lamp use, are expected to drive demand for LED-based smart lighting. The global lighting industry consumes roughly 19% of total electricity and contributes around 6% of greenhouse gas emissions. In contrast, LED smart lights are highly efficient, using nearly 70% less energy, have longer lifespans, and are mercury-free, which minimizes their environmental impact. Due to these advantages, LED technology has transformed the lighting industry and become the preferred choice in the smart lighting sector among both vendors and consumers.

The adoption of smart lights is expected to rise due to benefits like controlled energy usage, longer lifespans, adjustable lighting settings, and the availability of modern decorative designs. Despite significant growth, smart lighting adoption in residential, commercial, and industrial sectors remains incomplete. Government initiatives promoting LED-based smart lights are expected to further boost demand, with countries like China, Brazil, Colombia, Mexico, France, Spain, and Germany enacting bans on incandescent lamps to promote LED lights. The COVID-19 pandemic did affect the industry, with delayed construction projects, reduced consumer purchasing power, and disrupted supply chains impacting the demand for smart lights. However, as the industry recovers, smart lighting adoption is likely to increase, supported by resuming construction activity.

Smart lighting systems incorporate multiple components, such as lighting fixtures that collect environmental data and enable users to control lighting as needed. The development of the Internet of Things (IoT) has significantly boosted the smart lighting market, enabling applications such as ambient sensing and voice control. Additionally, the growing capabilities of wired and wireless communication protocols, including Bluetooth, Wi-Fi, ZigBee, DALI, EnOcean, and Sigfox, allow lighting systems to respond to real-time data and adjust settings. For instance, Philips' Hue Lighting is a smart home lighting system that allows full control over lighting through a smartphone app, reflecting the rising demand for smart lighting solutions.

LED prices have declined in recent years due to factors such as LED chip overproduction and slower demand growth in the backlighting segment. This price drop has enabled the introduction of affordable LED options in general household lighting. Governments worldwide continue to promote LED adoption due to its energy efficiency, cost-effectiveness, and longevity. Concerns about non-renewable power consumption, greenhouse emissions, and environmental degradation are on the rise among consumers and businesses, particularly as lighting accounts for about 15% of global electricity use and around 5% of greenhouse gas emissions. Promoting energy-saving lighting can therefore significantly reduce emissions and improve environmental health. Many governments and policymakers have implemented initiatives to encourage sustainable lighting products, and increased awareness about health and energy conservation may further drive demand for these products.

Application Insights

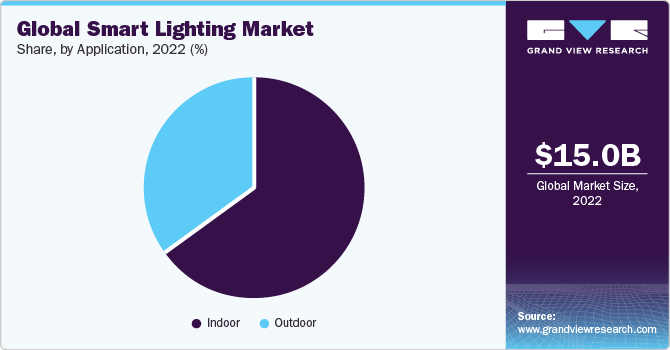

In 2022, the indoor segment held the largest revenue share at 65.5%. Indoor applications include residential, commercial, and industrial settings. The residential segment is expected to grow rapidly as consumers increasingly adopt smart bulbs and fixtures for mood-based lighting. In commercial and industrial spaces, smart lighting helps control energy use since office spaces and warehouses often require continuous lighting. Smart lighting systems with built-in sensors ensure that lights operate only where needed, based on movement and natural light levels, saving energy and reducing costs.

The outdoor segment is projected to grow at the highest CAGR of 22.8% over the forecast period, covering highways, roadways, architectural lighting, and other applications. Outdoor architectural lighting includes lighting for patios, gardens, and building exteriors in both residential and commercial spaces. The need for energy-efficient lighting solutions and outdoor activity monitoring is driving demand for outdoor smart lighting, particularly in smart street lighting. Governments are investing in LED-based smart lighting systems equipped with cameras and sensors to monitor and report outdoor activity, further contributing to market growth.

Order a free sample PDF of the Smart Lighting Market Intelligence Study, published by Grand View Research.