The global buy now pay later (BNPL) market was valued at approximately USD 6.13 billion in 2022 and is projected to experience significant growth at a compound annual growth rate (CAGR) of 26.1% from 2023 to 2030. In 2022, the total value of BNPL transactions exceeded USD 200 billion. A key factor driving this market is the growing consumer preference for flexible and convenient payment options. BNPL services allow customers to make purchases without having to pay upfront, offering increased financial flexibility and reducing the burden of immediate costs. Additionally, the surge in e-commerce has significantly contributed to the growth of the BNPL market. As online shopping becomes increasingly popular, consumers are looking for seamless and efficient payment methods. BNPL services integrate smoothly into online checkout processes, facilitating a quick and hassle-free payment experience. The expansion of e-commerce platforms and the widespread use of digital wallets have made BNPL solutions appealing to both customers and merchants.

BNPL services also tackle the issue of affordability for consumers. By enabling the division of payments into interest-free installments, BNPL providers allow customers to make larger purchases without the worry of financial strain. This capability has resulted in increased average order values and repeat business for merchants, as customers feel more comfortable making significant purchases. Moreover, the ease of accessing and signing up for BNPL services has played a significant role in their rise in popularity. Most BNPL platforms offer simple and rapid registration processes, often requiring minimal credit checks. This inclusivity attracts a wider consumer demographic, including those with limited credit history or lower credit scores, who might struggle to obtain traditional credit.

Gather more insights about the market drivers, restrains and growth of the Global Buy Now Pay Later Market

Beyond the benefits for consumers, BNPL providers present enticing partnerships and incentives for merchants. By collaborating with BNPL platforms, retailers can attract new customers, enhance loyalty, and boost conversion rates. BNPL services also assist merchants in lowering cart abandonment rates by offering an alternative payment option that encourages customers to finalize their purchases. Additionally, regulatory support and evolving payment regulations have positively influenced the BNPL market. Governments and financial regulators in various regions have acknowledged BNPL services as a legitimate payment method, enhancing their credibility and fostering consumer confidence. This regulatory endorsement has motivated BNPL providers to broaden their offerings and enter new markets, further fueling the industry’s expansion.

However, a potential challenge in the BNPL market is the risk of rising consumer debt. As BNPL services gain popularity, there is a concern that consumers may be tempted to overspend, leading to an accumulation of debt that could become difficult to manage. To mitigate this risk and promote responsible lending practices, BNPL providers should implement rigorous credit checks and evaluate each customer’s creditworthiness prior to offering their services. Furthermore, educational initiatives and transparent communication regarding the terms and conditions of BNPL options can empower consumers to make informed financial decisions and prevent excessive debt.

COVID-19 Impact Analysis

The COVID-19 pandemic has positively influenced the BNPL market. During the pandemic, many individuals faced financial hardships and uncertainties, prompting them to seek flexible payment solutions to manage their expenses. BNPL services emerged as an attractive alternative, allowing consumers to spread payments over time and alleviate financial pressure. Additionally, with physical stores closing and in-person shopping restricted, there was a significant increase in e-commerce activities. Consumers turned to online shopping for both essential and non-essential items, and BNPL services seamlessly integrated into these digital transactions, providing a convenient and efficient payment option.

End-Use Insights

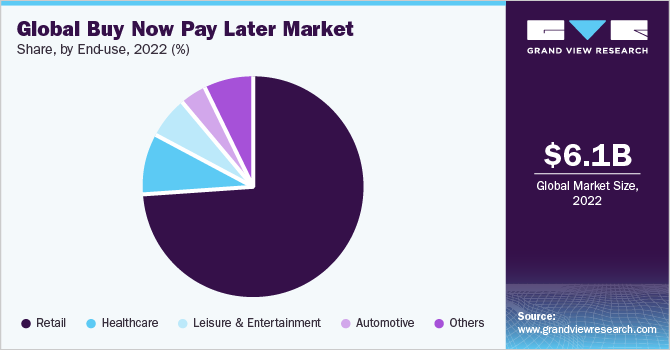

In terms of end-use, the retail segment led the market in 2022, accounting for over 73.0% of the revenue share. The industry is witnessing a growing adoption of BNPL solutions as they enable customers to easily distribute the cost of their purchases over predetermined, interest-free payment plans. For instance, in October 2021, Affirm, Inc., a BNPL solution provider, announced a partnership with Theory, a clothing retailer, to offer customers interest-free payment options for accessories and sportswear. Such developments are favorable for the continued growth of this segment.

The healthcare sector is projected to show promising growth with a significant CAGR during the forecast period. There is an increasing acceptance of BNPL payment methods in healthcare, as they provide a low-friction alternative to credit cards. Customers tend to favor BNPL options over credit cards to avoid high compounding interest and hidden fees. Moreover, the rising costs associated with treatments for various illnesses, including cancer, chronic heart disease, and cardiovascular diseases, are expected to drive the demand for BNPL services in the healthcare sector throughout the forecast period.

Order a free sample PDF of the Buy Now Pay Later Market Intelligence Study, published by Grand View Research.