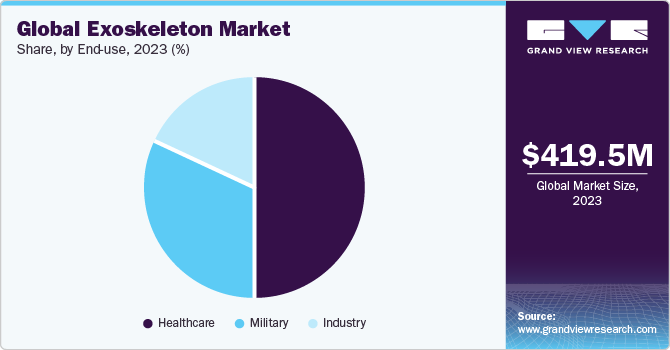

The global exoskeleton market was valued at approximately USD 419.5 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 16.6% from 2024 to 2030. In terms of volume, the market saw 13,643 units in 2023, with an expected growth rate of 9.3% CAGR from 2024 to 2030. This growth is driven by factors such as an aging population worldwide, rising adoption of medical devices across sectors like automotive, military, defense, and construction, as well as increasing incidence of stroke. Another key driver of market demand is the rising rate of spinal cord injuries (SCI). For example, the National Spinal Cord Injury Statistical Center (NSCISC) reports that in the U.S. alone, 17,730 new SCI cases are recorded each year, with an estimated 291,000 individuals living with SCI.

Exoskeletons are increasingly used across various industries to support worker health and enhance productivity. This growing demand has led to the emergence of several startups specializing in exoskeleton technology, particularly for rehabilitation purposes. Industry innovation is advancing as companies strive to develop products that increase adoption. For instance, in June 2022, Ekso Bionics received 510(k) FDA clearance for its EksoNR robotic exoskeleton, a next-generation device intended for rehabilitation of multiple sclerosis patients.

Gather more insights about the market drivers, restrains and growth of the Global Exoskeleton Market

In the construction industry, common musculoskeletal injuries include occupational overuse syndrome (OOS), cumulative trauma disorders (CTD), and repetitive strain injury (RSI). According to the World Health Organization (WHO), as of July 2022, around 1.71 billion people worldwide suffer from musculoskeletal disorders, which include conditions like neck and lower back pain, fractures, amputations, rheumatoid arthritis, and osteoarthritis. The U.S. Bureau of Labor Statistics reported that in 2022, approximately 502,380 workers experienced occupation-related musculoskeletal disorders across various sectors. Exoskeleton solutions help address these issues by enhancing user physical capability, health, and productivity while reducing fatigue, which is particularly beneficial for industrial workers.

Rapid technological advancements are anticipated to drive further demand for exoskeletons. The growing popularity of exoskeleton technology and its adoption across industries like manufacturing, logistics, automotive, and construction are also fueling market growth. For example, in December 2021, companies like IKEA and BMW adopted the Bionic Cray X, a fifth-generation AI-enabled exoskeleton that supports lifting up to 70 pounds and helps reduce risks of repetitive stress and back injuries. Such advancements are expected to accelerate market growth in the coming years.

Extremity Insights

In terms of specific applications, the lower body segment led the exoskeleton market with a revenue share of 42.0% in 2023. This was primarily due to increased investment, the prevalence of lower body disabilities, and growing adoption among older adults and paralyzed individuals who benefit from these exoskeletons’ weight-bearing and mobility capabilities. Additionally, military and defense personnel use lower-body exoskeletons to enhance soldiers’ speed and mobility. For instance, in February 2021, Paramount Group and Sarcos Robotics signed a Memorandum of Understanding (MoU) to bring advanced robotic systems for defense applications to industrial clients and governments across the Middle East and Africa.

The upper body segment is expected to experience the fastest CAGR over the forecast period. Exoskeletons for upper extremities provide support to people with disabilities and serve as rehabilitation tools for those recovering from stroke, neurological, or musculoskeletal impairments. Increased prevalence of neurological disorders also contributes to this segment’s growth. For example, in May 2022, data from the European Academy of Neurology indicated that one in three people globally will experience a neurological disorder at some point in their lifetime.

Order a free sample PDF of the Exoskeleton Market Intelligence Study, published by Grand View Research.