The global botulinum toxin market was valued at USD 11.1 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.8% from 2024 to 2030. Botulinum toxin is a neurotoxin and protein produced by the bacterium Clostridium botulinum. It acts as a selective blocker of acetylcholine, a neurotransmitter, which disrupts neural transmission when injected into muscles. This makes botulinum toxin one of the most extraordinary substances in the fields of medicine and science. Over the past decade, its use in cosmetology has surged, making it one of the most popular aesthetic procedures globally. The rising focus on aesthetics in both developed and developing regions has significantly contributed to the increased number of cosmetic procedures.

The market's growth is also propelled by the availability of a range of botulinum toxin products, including Botox, Xeomin, Dysport, and others. These products are widely used in aesthetic treatments, such as reducing glabellar lines, performing chemical browlifts, and treating forehead lines. Currently, there are several commercially available botulinum toxin Type-A products and one Type-B product (Myobloc) on the market.

Gather more insights about the market drivers, restrains and growth of the Global Botulinum Toxin Market

In addition to aesthetic applications, investments in research and development (R&D) by leading manufacturers are opening up new opportunities for therapeutic uses of botulinum toxin, which could lead to further market expansion. The shift from invasive to minimally invasive procedures is another factor expected to drive market growth in the coming years. For example, according to the International Society of Aesthetic Plastic Surgery (ISAPS), 17,598,888 non-invasive procedures were performed worldwide in 2021, with 5,355,604 in the U.S. Many people are opting for permanent procedures like fillers, fat grafting, and lip enhancement.

Minimally invasive procedures offer benefits such as smaller incisions, shorter hospital stays, faster recovery, less pain, and fewer complications compared to invasive surgeries. This is likely to drive the demand for botulinum toxin in the forecast period. Additionally, many dermatologists believe that the COVID-19 pandemic may have increased interest in aesthetic procedures, leading to higher demand post-pandemic.

In a 2020 survey by the American Society of Plastic Surgeons, 11% of 1,000 American women indicated they were more inclined to undergo minimally invasive procedures after the pandemic than before. Even during the pandemic, Botox and soft tissue fillers remained among the most popular minimally invasive treatments in the U.S.

End-Use Insights

The market is segmented into hospitals, dermatology clinics, and spas & cosmetic clinics based on end-use. In 2023, cosmetic centers and medspas held the largest market share of 44.5%. The growing preference for aesthetic treatments in dermatology clinics, cosmetic centers, and medspas significantly contributed to the segment's growth, with an expected CAGR of 10.2%. Medical spas and plastic surgeons are witnessing an increasing number of customers, and the rising number of medical cosmetic centers and medspas, especially in regions like Asia Pacific, is fueling market growth.

The hospital segment accounted for 43.4% of revenue in 2023. The segment’s growth is attributed to the increasing number of hospitals with advanced care facilities in both developed and developing countries, as well as growing awareness of aesthetic procedures. Most therapeutic treatments, such as those for dystonia, spasticity, and chronic migraines, are performed in hospitals.

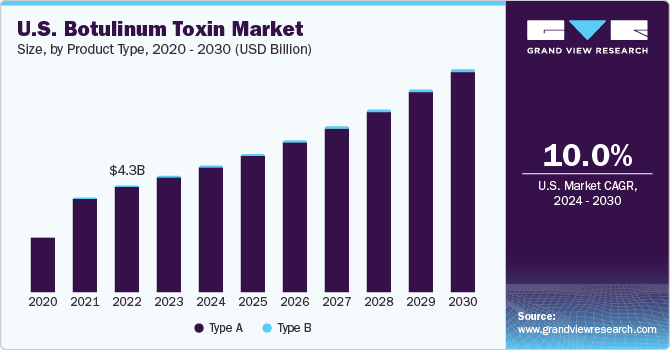

Product Type Insights

Botulinum toxin type-A dominated the market with a revenue share of 98.8% in 2023. Its popularity is expected to continue growing due to its advantages, including minimal pain, no blood loss, and the absence of scarring during procedures. Botulinum toxin type-A has also been used to treat various neurological conditions, such as chronic migraines and tension-type headaches.

Botulinum toxin type-A products are widely adopted for both therapeutic and aesthetic applications, and with the rising demand for beauty treatments, the segment is expected to expand further. The botulinum toxin market is divided into two product categories: botulinum toxin type-A and type-B. Various type-A products, such as Botox and Dysport, are clinically proven to be safe and effective over the long term, with minimal side effects, which further drives their adoption.

Order a free sample PDF of the Botulinum Toxin Market Intelligence Study, published by Grand View Research.