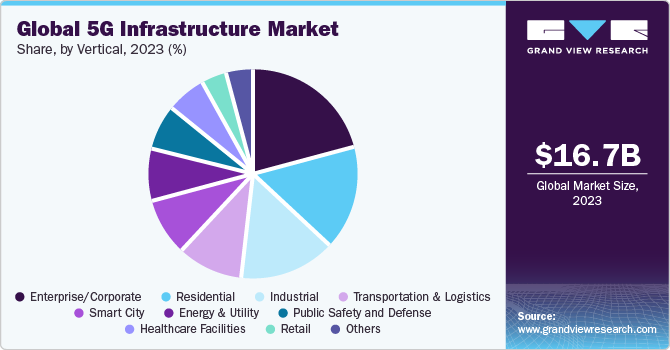

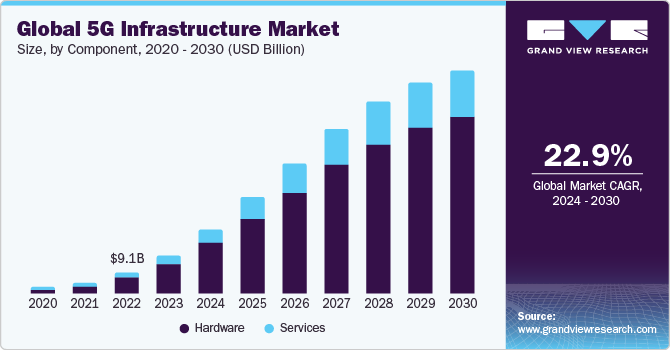

The global 5G infrastructure market, valued at $16.69 billion in 2023, is projected to expand at a remarkable 22.9% CAGR from 2024 to 2030. This rapid growth is primarily driven by the surge in mobile data traffic and the proliferation of smart cities equipped with IoT applications. The increased investment in 5G networks by governments and telecom companies is creating favorable conditions for market expansion. Additionally, the rising demand for connected devices in sectors like smart buildings and remote healthcare is further contributing to market growth.

Worldwide data traffic, particularly mobile data traffic, has witnessed exponential growth in recent years. According to the Mobile Data Traffic Outlook report by Telefonaktiebolaget LM Ericsson, global mobile data traffic (excluding traffic from fixed wireless access) reached a staggering 130 exabytes per month by the end of 2023. This figure is anticipated to triple to 403 exabytes per month by 2029. The combination of this growing data traffic and a preference for 5G networks presents significant opportunities for market expansion.

The emergence of smart cities in major countries, such as the United States, Japan, China, Germany, Italy, the United Kingdom, and India, has accelerated the adoption of IoT technology for various applications, including transportation, energy management, and public safety and security. This trend further fuels the demand for 5G infrastructure, as it provides the necessary connectivity and capacity to support these advanced IoT applications.

Gather more insights about the market drivers, restrains and growth of the 5G Infrastructure Market

Component Segmentation Insights

The hardware segment, encompassing RAN, core network, backhaul & transport, fronthaul, and midhaul, dominated the market in 2023, accounting for a substantial 77.18% of the total revenue share. As the cornerstone of 5G infrastructure, RAN, which connects devices through a radio link, is a critical component. Key industry players are actively investing in and innovating RAN 5G infrastructure. A notable example is Parallel Wireless, Inc., which announced the availability of a hardware-agnostic standalone (SA) 5G software stack in December 2023. This innovative solution empowers public safety networks, private networks, and operators to deploy their RAN infrastructure across diverse processor hardware platforms, fostering growth in the RAN segment.

The services segment, comprising consulting, implementation & integration, support & maintenance, and training & education, is poised for significant growth from 2024 to 2030. Among these, the support & maintenance segment is anticipated to experience substantial expansion driven by the increasing deployment of 5G infrastructure. This surge in deployment necessitates support & maintenance services to ensure the optimal functioning of the equipment. Understanding software technicalities, repairing breakdowns, upgrading infrastructure, and staying abreast of the latest technologies & market trends are paramount considerations in 5G implementation. Neglecting these factors can lead to decreased productivity, emphasizing the growing demand for support & maintenance services in the years to come.

Order a free sample PDF of the 5G Infrastructure Market Intelligence Study, published by Grand View Research.