The global sportswear market size was valued at USD 335.92 billion in 2023 and is expected to grow at a CAGR of 9.9% from 2024 to 2030. The global market is driven by factors such as rising health consciousness, increasing participation in sports and fitness activities, and the growing trend of sports clothes, where athletic clothing is worn in casual settings. Advances in fabric technology, such as moisture-wicking, odor control, and temperature regulation, enhance the functionality and appeal of sportswear. Additionally, the influence of social media and celebrity endorsements has amplified brand visibility and consumer interest. The expansion of e-commerce platforms has made sportswear more accessible, while the emphasis on sustainability and eco-friendly materials resonates with environmentally conscious consumers.

The increasing health consciousness among consumers is one of the primary drivers of the global sportswear market. The growing awareness of the importance of maintaining a healthy lifestyle has led to a surge in participation in various physical activities, including running, yoga, gym workouts, and team sports. According to a report by the World Health Organization, the number of people engaging in regular physical activity has risen significantly over the past decade, contributing to the heightened demand for sportswear. This shift towards a healthier lifestyle is not just limited to younger demographics but also includes older adults who are adopting fitness regimes to improve their overall well-being.

Gather more insights about the market drivers, restrains and growth of the Global Sportswear Market

Product Insights

Sports footwear accounted for a revenue share of 64.8% in 2023 due to its essential role in various athletic activities and the significant technological advancements in this segment. Athletes and fitness enthusiasts require specialized footwear designed to enhance performance, provide comfort, and prevent injuries. The demand for running shoes, basketball shoes, soccer cleats, and other sports-specific footwear has surged as more people engage in sports and fitness routines. Additionally, innovations such as cushioned soles, lightweight materials, and improved traction have attracted consumers looking for optimal support and functionality. Major brands like Nike, Adidas, and Under Armour have consistently invested in research and development to introduce cutting-edge technologies, such as Nike's Flyknit and Adidas' Boost, which have garnered significant consumer interest. The rise of athleisure has also contributed to the popularity of sports footwear, as many consumers now seek versatile shoes that can be worn both for athletic activities and casual outings.

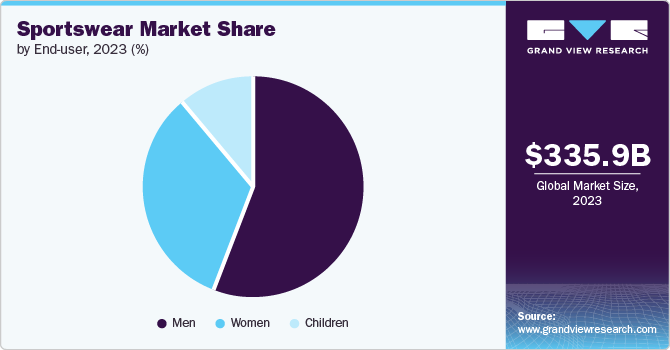

End-user Insights

Men’s sportswear accounted for a revenue share of 55.6% in 2023 due to higher participation rates in various sports and fitness activities. Historically, sports and physical activities have been more popular among men, leading to greater demand for sportswear tailored to their needs. This trend is reflected in the product offerings of major sportswear brands, which often focus on men's athletic apparel and footwear. Additionally, male consumers tend to invest more in sports gear and equipment, driven by a strong interest in performance enhancement and brand loyalty. The influence of male athletes and sports celebrities also plays a significant role in driving demand, as endorsements and sponsorships by well-known figures like LeBron James, Cristiano Ronaldo, and Roger Federer boost the visibility and desirability of sportswear brands. However, the market dynamics are gradually shifting, with increasing female participation in sports and fitness activities.

Distribution Channel Insights

The sales of sportswear through sporting goods retailers accounted for a revenue share of 34.2% in 2023 due to their specialized focus on sports and fitness products, which attracts a dedicated consumer base. These retailers offer a wide range of sportswear, footwear, and equipment, providing a one-stop shop for consumers looking for quality products. Their expertise and knowledgeable staff enhance the shopping experience, helping customers find the right gear for their specific needs. Additionally, sporting goods stores often feature branded sections or dedicated areas for major sportswear brands, giving consumers access to the latest products and innovations. The strategic location of these stores in malls and shopping centers further boosts foot traffic and sales. Companies like Dick's Sporting Goods, Decathlon, and Foot Locker have established strong brand reputations and customer loyalty by consistently offering high-quality sportswear and superior customer service.

Browse through Grand View Research's Consumer Goods Industry Research Reports.

- Smart Refrigerators Market: The global smart refrigerators market size was valued at USD 3.89 billion in 2023 and is projected to grow at a CAGR of 7.1% from 2024 to 2030.

- Poppy Seeds Market: The global poppy seeds market size was estimated at USD 325.0 million in 2023 and is expected to grow at a CAGR of 4.7% from 2024 to 2030.

Regional Insights

The sportswear market in North America accounted for a revenue share of 33.3% in 2023, due to its strong sports culture, high disposable income, and advanced retail infrastructure. The region's consumers are highly engaged in various sports and fitness activities, leading to sustained demand for sportswear. The presence of major sports leagues, such as the NFL, NBA, and MLB, and their associated merchandise also boost the market. Additionally, North America is home to some of the largest sportswear brands, including Nike and Under Armour, which drive innovation and set trends in the industry. The region's consumers have a high propensity to spend on premium sportswear, driven by a combination of health consciousness, fashion trends, and brand loyalty. The extensive network of retail stores, both physical and online, ensures easy access to a wide range of sportswear products. Furthermore, the influence of social media and celebrity endorsements is particularly strong in North America, enhancing brand visibility and consumer engagement.

Key Sportswear Company Insights

The global sportswear market is characterized by the presence of numerous players such as Nike, Inc.; Adidas AG; LI-NING Company Limited; Umbro Ltd.; and Under Armour, among others. These companies, along with several emerging players, contribute to a competitive landscape that fosters continuous innovation. Major brands invest heavily in research and development to introduce advanced materials, cutting-edge designs, and new technologies that enhance performance, comfort, and style. They also engage in strategic partnerships, sponsorships, and endorsements with athletes and sports teams to strengthen their market presence and brand recognition. Furthermore, these companies are increasingly focusing on sustainability, incorporating eco-friendly materials and ethical production practices to meet the growing consumer demand for sustainable products.

Key Sportswear Companies:

The following are the leading companies in the sportswear market. These companies collectively hold the largest market share and dictate industry trends.

- Nike, Inc.

- Adidas AG

- LI-NING Company Limited

- Umbro Ltd.

- Puma SE, Inc.

- Fila, Inc.

- Lululemon Athletica Incorporation

- Under Armour

- Columbia Sportswear Company

- Anta Sports Products Limited, Inc.

Order a free sample PDF of the Sportswear Market Intelligence Study, published by Grand View Research.