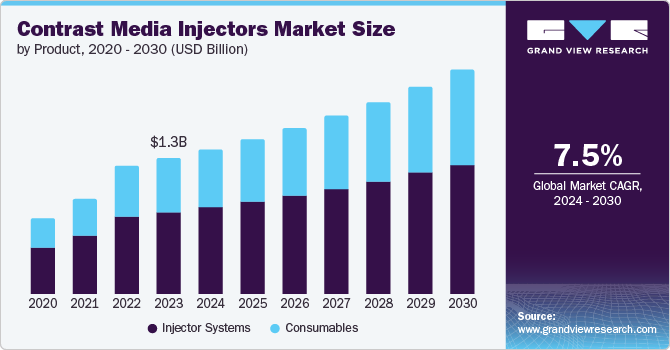

The global contrast media injectors market size was valued at USD 1.27 billion in 2023 and is projected to grow at a CAGR of 7.50% from 2024 to 2030. The contrast media injectors market growth is attributed to the rising prevalence of chronic disorders, technological advancements, and increasing demand for minimally invasive surgical procedures. The rising number of chronic diseases has harnessed the demand for diagnostic imaging tests that use conventional imaging methods such as X-rays and ultrasounds, along with advanced imaging techniques such as CT scans and MRIs. The ability of these tests to diagnose diseases and help to decide on surgeries/treatments in interventional procedures, as well as their use for perioperative imaging before surgeries, is likely to increase the number of contrast media procedures. Thus, the rising prevalence of long-term diseases and complex co-morbidities are major factors propelling market growth.

Moreover, rapid advancements in technology, increased spending on healthcare, and enhancements in patient care quality are leading to the worldwide rise in the demand for minimally invasive surgical procedures. Contrast media injectors are invaluable tools for surgeons. They help them precisely administer contrast agents, thereby minimizing human errors and enhancing the precision and efficiency of operations. These products are essential in the fields of intraoperative interventional radiology and interventional cardiology. The presence of sophisticated injection systems for both diagnostic and intraoperative imaging purposes is expected to drive their increased adoption.

Gather more insights about the market drivers, restrains and growth of the Contrast Media Injectors Market

Detailed Segmentation:

Product Insights

The injector systems held the highest revenue share in 2023. Contrast agents are delivered into the patient's bloodstream during CT, MRI, and angiogram imaging procedures, allowing for improved visualization of the contrast of fluids or structures within the body. CT injector systems, MRI injector systems, and cardiovascular/angiography injector systems are all examples of contrast media injector systems. The CT injector systems segment accounts for the largest revenue share in the contrast media injectors market. This can be attributed to their widespread use in the detection and treatment of vascular disease, cancer, orthopedic injuries, and disorders. Moreover, technological advancements and the launch of new products are expected to propel market growth further.

Type Insights

In 2023, the single-head injectors category led the market by capturing the largest revenue, accounting for 43.60%. Known for their use in angiography, CT, and MRI procedures, single-head injectors are favored due to their straightforward mechanism involving a single syringe to administer contrast media. Primarily used in angiography, these injectors differ from their dual-head counterparts, which employ two syringes and are often used in CT systems. Their widespread application, coupled with a lower average selling price, makes single-head injectors particularly appealing to customers in developing countries such as China, India, and Brazil, where financial considerations play a significant role in purchasing decisions, thereby fueling market expansion.

Application Insights

The contrast media injectors market is analyzed for radiology, interventional radiology, and interventional cardiology. In 2023, the radiology segment dominated the market with the largest revenue share of 46.94%. Radiology involves the use of noninvasive imaging technologies such as CT and MRI scans to create comprehensive images. CT scanning involves using X-ray equipment to build a structure of cross-sectional pictures of the body to detect the source of a medical condition, especially in soft tissues. In contrast, MRI technology involves the application of a magnetic field to create images of the inside of a patient’s body. These injectors are used with MRI and CT to identify a broad range of health conditions such as breast cancer, heart diseases, gastrointestinal conditions, fractures, colon cancer, and blood clots. In addition, this segment is projected to grow at a lucrative rate owing to the non-invasive nature of radiology techniques and a rise in the prevalence of chronic diseases.

End-use Insights

The hospital segment dominated the market and accounted for the largest revenue share of 68.37% in 2023. Additionally, this segment is expected to grow at the highest CAGR from 2024 to 2030. This growth can be attributed to the increasing admissions of patients suffering from neurological disorders, cardiovascular diseases, and cancer. Hospitals are the primary users of contrast media injectors, owing to their wide range of applications in radiology, interventional radiology, and interventional cardiology. For instance, according to the 2022 data published by the American Hospital Association, there are 6,120 hospitals in the U.S. Additionally, an increasing focus on the development of healthcare infrastructure in developing countries is expected to propel the market growth.

Regional Insights

North America dominated the market and accounted for 38.08% revenue share in 2023 owing to the presence of well-established healthcare facilities and easy availability of advanced technologies. Additionally, the increasing demand for diagnostic procedures in the region is expected to increase the number of inpatient examinations, which is expected to boost market growth.

Browse through Grand View Research's Medical Devices Industry Research Reports.

• The global cardiac safety services market size was estimated at USD 870.48 million in 2023 and is projected to grow at a CAGR of 12.0% from 2024 to 2030. The market expansion is fueled by the rising prevalence of cardiovascular diseases, regulatory requirements, increasing complexity of clinical trials and the growing focus on personalized medicine.

• The global osteosynthesis devices market size was estimated at USD 9.91 billion in 2023 and is projected to grow at a CAGR of 8.30% from 2024 to 2030. Factors such as the growing prevalence of osteomalacia and osteoporosis and the rising incidence of sports injuries and road accidents fuel the demand for osteosynthesis devices across the globe.

Key Companies profiled:

• Bayer HealthCare LLC

• Bracco Group

• Ulrich Medical

• Guerbet Group

• Medtron AG

• Nemoto Kyorindo Co., Ltd.

• Hong Kong Medi Co Limited

Contrast Media Injectors Market Segmentation

Grand View Research has segmented the global contrast media injectors market on the basis of product, type, application, end-use, and region:

Contrast Media Injectors Product Outlook (Revenue, USD Million, 2018 - 2030)

• Injector Systems

o CT injector systems

o MRI injector systems

o Cardiovascular/angiography injector systems

• Consumables

o Tubing

o Syringe

o Interventional Radiology

Contrast Media Injectors Type Outlook (Revenue, USD Million, 2018 - 2030)

• Single-head Injectors

• Dual-head Injectors

• Syringeless Injectors

Contrast Media Injectors Application Outlook (Revenue, USD Million, 2018 - 2030)

• Radiology

• Interventional Cardiology

• Interventional Radiology

Contrast Media Injectors End-use Outlook (Revenue, USD Million, 2018 - 2030)

• Hospitals

• Diagnostic Centers

• Ambulatory Surgery Centers

Contrast Media Injectors Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o France

o Italy

o Spain

o Denmark

o Sweden

o Norway

• Asia Pacific

o China

o Japan

o India

o South Korea

o Australia

o Thailand

• Latin America

o Brazil

o Argentina

• MEA

o South Africa

o Saudi Arabia

o UAE

o Kuwait

Order a free sample PDF of the Contrast Media Injectors Market Intelligence Study, published by Grand View Research.

Recent Developments

• In November 2023, Bracco partnered with ulrich medical for syringeless magnetic resonance injectors. This partnership helped Bracco to launch its product in the U.S. market.

• In November 2022, GE Healthcare and ulrich medical collaborated to offer multi-dose contrast media injectors in the U.S. This injector delivers iodinated contrast media for CT imaging procedures, reducing procedure setup time and increasing patient throughput.

• In November 2022, GE Healthcare announced an investment of USD 80 million to increase contrast media production capacity. By 2025, GE Healthcare aims to manufacture 30 million more doses of contrast media every year, which is anticipated to boost the market's growth in the near future.

• In September 2019, Bayer launched the MEDRAD Stellant FLEX computed tomography (CT) injection system with an advanced injector system that drives individualized patient protocols and personalized imaging.