The global clinical trial imaging market size was estimated at USD 1.14 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.60% from 2024 to 2030. The market growth is anticipated to be fueled by the growing biotechnology and pharmaceutical sectors, coupled with rising investments in research and development for the creation of new drugs aimed at treating various diseases. Medical imaging plays a pivotal role in advancing the development of innovative life science products.

Despite the ever-changing nature of the medical imaging industry, the biotechnology and pharmaceutical industries are showing sustained growth. This is primarily due to the increased investment in medical imaging companies, as well as the occurrence of mergers and acquisitions that involve the incorporation of cutting-edge imaging technologies to facilitate clinical trials for medical devices.

Gather more insights about the market drivers, restrains and growth of the Clinical Trial Imaging Market

Detailed Segmentation

Service Insights

Based on service, the project and data management services segment held the market with the largest revenue share of 28.73% in 2023. Clinical trials that utilize imaging often require comprehensive data management and seamless coordination among multiple stakeholders. These services encompass various aspects, including operational expertise, the development of trial workflows, project tracking, the conversion of scans into digital images, regulatory oversight, quality assurance, real-time reporting on trial progress, establishment and oversight of MRI centres, data management, and handling reporting and issue resolution. Furthermore, the U.S. government has approved a cloud-based server to safeguard all medical imaging records, including annotated and base images, while ensuring protection against natural disasters. This system allows for faster and easier retrieval of these critical medical records.

Service Insights

Based on service, the project and data management services segment held the market with the largest revenue share of 28.73% in 2023. Clinical trials that utilize imaging often require comprehensive data management and seamless coordination among multiple stakeholders. These services encompass various aspects, including operational expertise, the development of trial workflows, project tracking, the conversion of scans into digital images, regulatory oversight, quality assurance, real-time reporting on trial progress, establishment and oversight of MRI centres, data management, and handling reporting and issue resolution. Furthermore, the U.S. government has approved a cloud-based server to safeguard all medical imaging records, including annotated and base images, while ensuring protection against natural disasters. This system allows for faster and easier retrieval of these critical medical records.

Application Insights

In terms of application, the oncology segment held the market with the largest revenue share of 28.98% in 2023. The factors such as high prevalence of cancer cases and constant need for new and innovative therapies to treat various types of cancer are expected to fuel the market growth. Oncology trials often involve complex imaging requirements due to the need to assess tumour size, response to treatment, and disease progression. Various imaging modalities, such as CT scans, MRI, PET scans, and others, are used to evaluate the effectiveness of cancer treatments. This complexity results in a larger share of the market being dedicated to oncology. Advances in imaging technologies, such as PET-CT, molecular imaging, and functional MRI, have significantly improved the ability to visualize and assess tumours and their response to treatment. These advances have made imaging an integral part of oncology trials. The global cancer burden continues to increase, leading to a growing number of oncology clinical trials. This trend is expected to drive the dominance of the oncology segment in the global market.

End-use Insights

Based on end-use, the contract research organizations (CROs) segment led the market with the largest revenue share of 45.95% in 2023. This significant market share can be attributed to the snowballing cost of drug development along with the increased research & development activities. In addition, mounting demand by the biotechnology and pharmaceutical companies for the outsourcing of research and development activities to reduce expenses is driving the market growth. Also, contract research outsourcing collaborations offer cutting-edge services. Therefore, government organizations prefer the handover of projects to the CROs.

Regional Insights

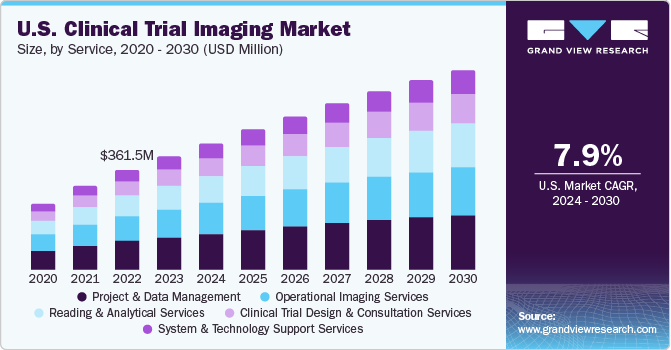

North America dominated the market with a revenue share of 40.73% in 2023. This dominance is primarily due to several factors, including the presence of major outsourcing companies and a notable uptick in research and development activities within the region. Furthermore, the market in North America is driven by factors such as the rising elderly population and the increasing prevalence of chronic diseases. North America leads in terms of the sheer number of clinical trials conducted, and it is also the primary source of outsourcing activities in this field. The cost factor plays a significant role in the decision to outsource clinical trials to external research organizations.

Browse through Grand View Research's Medical Devices Industry Research Reports.

• The global exoskeleton market size was estimated at USD 419.5 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 16.6% from 2024 to 2030.

• The global botulinum toxin market size was valued at USD 11.1 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.8% from 2024 to 2030.

Key Companies profiled:

• IXICO plc

• Navitas Life Sciences

• Resonance Health

• ProScan Imaging

• Radiant Sage LLC

• Medpace

• Biomedical Systems Corp

• Cardiovascular Imaging Technologies

• Intrinsic Imaging

• BioTelemetry

Clinical Trial Imaging Market Segmentation

Grand View Research has segmented the clinical trial imaging market on the basis of on service, modality, application, end-use and region:

Clinical Trial Imaging Service Outlook (Revenue, USD Million, 2018 - 2030)

• Clinical Trial Design and Consultation Services

• Reading and Analytical Services

• Operational Imaging Services

• System and Technology Support Services

• Project and Data Management

Clinical Trial Imaging Modality Outlook (Revenue, USD Million, 2018 - 2030)

• Computed Tomography

• Magnetic Resonance Imaging

• X-Ray

• Ultrasound

• Optical Coherence Tomography (OCT)

• Others

Clinical Trial Imaging Application Outlook (Revenue, USD Million, 2018 - 2030)

• NASH

• CKD

• Diabetes

• Cardiovascular Diseases

• Ophthalmology

• Musculoskeletal

• Oncology

• Gastroenterology

• Pediatrics

• Others

Clinical Trial Imaging End-use Outlook (Revenue, USD Million, 2018 - 2030)

• Biotechnology and Pharmaceutical companies

• Medical Devices Manufacturers

• Academic and Government Research Institutes

• Contract Research Organizations (CROs)

• Others

Clinical Trial Imaging Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Denmark

o Sweden

o Norway

• Asia Pacific

o India

o China

o Japan

o Australia

o Thailand

o South Korea

• Latin America

o Brazil

o Mexico

o Argentina

• Middle East & Africa

o South Africa

o Saudi Arabia

o UAE

o Kuwait

Order a free sample PDF of the Clinical Trial Imaging Market Intelligence Study, published by Grand View Research.

Recent Developments

• In March 2023, Clario launched a cloud-based image viewer specifically for clinical trials. This innovation aims to streamline medical image analysis and improve its accessibility within the clinical research context

• In May 2023, Cleerly has partnered with ProScan Imaging to provide personalized solutions for cardiac health, which involve analyzing and devising treatment strategies for cardiovascular issues. The partnership is expected to leverage Cleerly's AI-powered platform to examine coronary CT angiography (CCTA) images