Roaming Tariff Industry Overview

The global roaming tariff market size was valued at USD 72.65 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.0% from 2023 to 2030. Some major factors driving the growth of the roaming tariff industry include the adoption of 3G, 4G, and 5G networking, increasing smartphone adoption, and rising international tourism, among others. Furthermore, increasing adoption of high-end mobile devices enabled with 3G, and 4G networking capabilities are also expected to drive market growth. Similarly, the emergence of 5G roaming services is also anticipated to power the development of the roaming tariff industry.

Gather more insights about the market drivers, restrains and growth of the Roaming Tariff Market

Additionally, owing to intense competition among key players, companies are engaged in introducing international roaming packages to maintain their customer base since customers switch from one service provider to the other due to price differentiation. These factors are expected to fuel market growth.

Roaming enables users to use their mobile devices outside the geographical coverage that home network operators provide. Roaming tariffs are the extra charges roamers pay when entering a foreign network. The additional charges are paid for various roaming services, such as SMS, data, and voice. Multiple factors are anticipated to fuel the growth of the roaming tariff industry. The rising development of mobile phone users, the growing popularity of 3G and 4G-enabled smartphones increasing unique subscribers, and mobile internet penetration are anticipated to positively impact the market growth over the forecast period.

Although international tourism has been a major contributor to the growth of the roaming tariff industry, a free trade agreement between various countries across the globe is expected to decelerate the growth of the roaming tariff industry. For instance, in January 2023, Brazil announced the scrapping of roaming charges for visitors to Chile by end of January 2023. This move comes as promised by a free trade agreement between the 2 countries. The mobile operators and MVNOs which offer international roaming services to users who are passing through Chile will be compelled to supply with the same tariff price as offered in Brazil.

Faster modes of transportation, which are also cost-effective, have paved the way for an increase in tourism, especially internationally. According to the United Nations World Tourism Organization (UNWTO), international tourist arrivals had tripled from January to July 2022, by 172%, compared to the same period in 2021. Increased tourism is a direct fuel to accelerating the growth of the market.

The companies in the roaming tariff industry are also coming up with initiatives targeting the tourist audience, which has also been able to drive the growth of the market. For instance, in December 2022, Bharti Airtel Ltd. Launched a new international roaming plan as part of the service caller, “World Pass” for both prepaid and postpaid users. The plan will be valid in 184 countries, with several international roaming plans.

An increase in purchasing power of the general public, especially in growing economies, has enabled the adoption of smartphones and other services. For instance, according to World Bank, the GDP per capita in Mexico in 2021 was USD 9,926.4, which increased from USD 8,431.7 in 2020. With the increase in purchasing power, the public will adopt new/better services, enabling the growth of all markets in general. Increased purchasing power, combined with increased smartphone availability and a wide variety of network services, will drive the development of the market during the forecast period.

The large number of companies in the roaming tariff industry, which operate in multiple countries, enables the adoption of network services even in countries located in remote parts of the world. For instance, Telefonica SA offers network services to countries such as Spain, Germany, and the U.K. among others. Additionally, the company has maintained strategic partnership agreements with service providers across more than 170 countries.

Similarly, Vodafone Group Plc. has business across 21 operating countries, moreover, the company has a partnership agreement with local operators in 47 countries, and 168 countries with 4G roaming services. Companies in the market operating across a large number of countries have also been fueling the growth of the market during the forecast period.

Browse through Grand View Research's Communication Services Industry Research Reports.

• The global commerce cloud market size was estimated at USD 17.78 billion in 2023 and is expected to grow at a CAGR of 22.8% from 2024 to 2030. The market is experiencing robust growth driven by several key factors.

• The global digital asset management market size was valued at USD 4.22 billion in 2023 and is projected to grow at a CAGR of 16.2% from 2024 to 2030. The proliferation of remote work and distributed teams has accelerated the adoption of digital asset management (DAM) systems.

Roaming Tariff Market Segmentation

Grand View Research has segmented the global roaming tariff market based on roaming type, distribution channel, service, and region:

Roaming Tariff Type Outlook (Revenue, USD Million, 2018 - 2030)

• National

• International

Roaming Tariff Distribution Channel Type Outlook (Revenue, USD Million, 2018 - 2030)

• Retail Roaming

• Wholesale Roaming

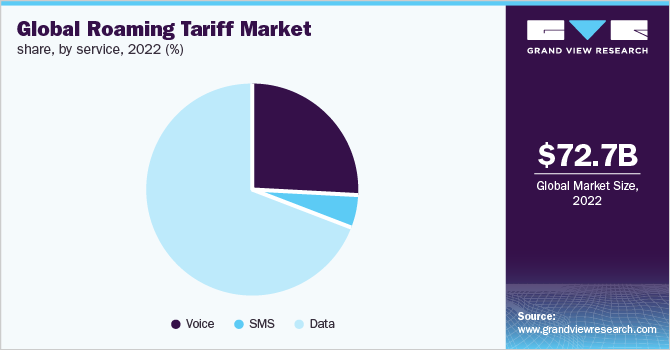

Roaming Tariff Service Outlook (Revenue, USD Million, 2018 - 2030)

• Voice

• SMS

• Data

Roaming Tariff Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o U.K.

o Germany

o France

o Rest of Europe

• Asia Pacific

o China

o India

o Japan

o Rest of Asia Pacific

• Latin America

o Brazil

o Mexico

o Rest of Latin America

• Middle East & Africa (MEA)

Order a free sample PDF of the Roaming Tariff Market Intelligence Study, published by Grand View Research.

Key Companies profiled:

• America Movil

• AT&T Inc.

• Bharti Airtel Ltd.

• China Mobile Ltd.

• Deutsche Telekom AG

• Digicel Group

• T-Mobile (Sprint Communication)

• Telefonica SA

• Verizon Communications Inc.

• Vodafone Group plc